- within Insolvency/Bankruptcy/Re-Structuring, Criminal Law and Law Practice Management topic(s)

FOREWORD

Australia is at a crossroads in its energy transition. With coal-fired power stations set to be decommissioned by 2035 and a target of 82% renewable energy by 2030, the nation has set ambitious goals to achieve net-zero emissions by 2050. Yet, despite record-breaking investment, government initiatives, and industry trials, the transition is faltering, struggling to attract sufficient private capital and investment. The challenges are mounting, and the stakes are enormous: billions of dollars in investment, the future of Australia's energy security, and its ability to meet global climate commitments.

In response, Prime Minister Anthony Albanese recently hosted a landmark foreign investment summit to Australia's energy transition and help bridge the nation's clean energy investment gap. At the same time, A&M believes there is already significant potential within the local market to further boost investment. Why? in August 2025, A&M conducted four Energy Exchange sessions with 40 senior executives from a diverse range of energy value chain participants, developers, government and private capital investors, highlighting the strong appetite for investment already present domestically.

100% of local private investors surveyed during the Energy Exchange series believe Australia must first go further to make energy investments more attractive. The challenge is not the availability of local capital but rather the investment's attractiveness. Creating an environment that encourages and sustains investment will require ongoing collaboration and support from government.

There was also unanimous agreement and keen interest in exploring decentralised Behind-the-Meter (BtM) renewable energy solutions in the commercial and industrial sector, viewed as a high-return and scalable opportunity provided the market is adequately de-risked.

This is not merely a policy issue it is an economic imperative. The choices made today will determine whether Australia remains a global leader in renewable energy or becomes a cautionary tale of missed opportunities.

ELLIE ATKINSON

MANAGING DIRECTOR

eatkinson@alvarezandmarsal.com

IGOR SADIMENKO

MANAGING DIRECTOR

isadimenko@alvarezandmarsal.com

AUSTRALIA'S RENEWABLE ENERGY SURGE: MOMENTUM AMIDST CHALLENGES

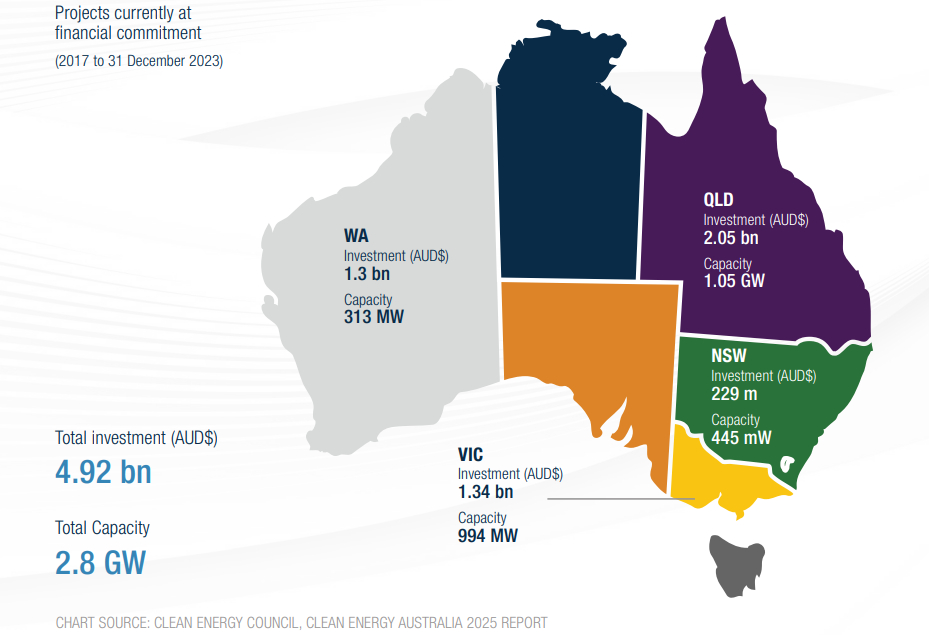

Australia's renewable energy sector is on the rise, breaking records and setting new benchmarks for growth. In 2024 alone, clean energy investments soared to an unprecedented AUD 12.7 billion1, with AUD 9 billion directed toward new generation capacity. This marks the highest level of investment since the 2018 record, with AUD 4.93 billion2 of that reaching financial commitment a clear signal of the sector's momentum.

Investment in and capacity of large-scale energy generation projects

Yet, while we have a direction and the numbers are impressive, they don't tell the full story. The government's "Future Made in Australia" package boasts a headline-grabbing AUD 22.7 billion3 allocation. But dig deeper, and the reality is less inspiring: only 10% a mere AUD 2.35 billion is earmarked for electricity transition enablement. This disconnect between ambition and the government's approach to incentive external market investment to enable execution, underscores the challenges Australia faces in turning bold targets into tangible outcomes.

FEDERAL AMBITIONS, STATE DECISIONS: AUSTRALIA'S ENERGY POWER STRUGGLE

One of the most fascinating aspects of Australia's renewable energy journey is also the role of Renewable Energy Zones (REZs). The NEM's 43 zones are the future backbone of the National Energy Market (NEM), each designed to seamlessly integrate renewable generation and firming capacity across Australia. Together, they aim to deliver an impressive 33 TWh of electricity annually by 2030.

But: while the federal government sets the overarching goals, REZs are state-declared and managed. This adds layers of complexity to the execution of our 2030 renewable energy target.

In Western Australia, the Wholesale Electricity Market (WEM) also operates independently of the NEM, with its own set of challenges and opportunities.

What's clear is that while substantial investment is already underway, the focus now shifts to how governments can continue streamlining coordination and reducing complexity laying the groundwork to unlock even greater levels of private investment and innovation.

THE INVESTMENT GAP: AMBITION MEETS REALITY

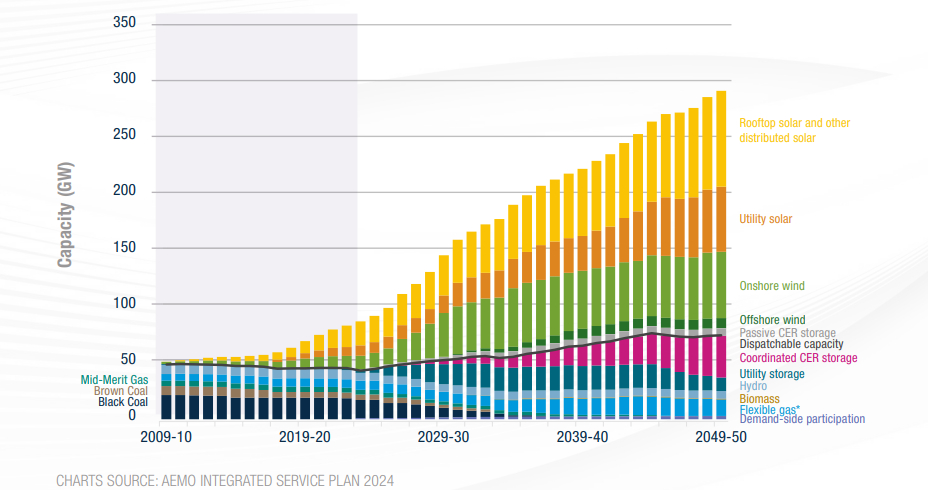

Already this decade, 12.5 gigawatts (GW) of new utility-scale generation and 1.3 GW/1.8 gigawatt hours (GWh) of storage has entered the NEM and 490 km of transmission has been built. A further 20 GW of generation and storage, and 2,090 km of transmission, are progressing from planning to delivery4. That's a solid start. Add to that another 20 GW from committed and probable projects, and you might think we're on track. But here's the reality: we need 85 GW to replace coal power stations by 2035. The gap is real and bridging it will take more than ambition it will take private capital stepping up in a big way.

Capacity Step Change across the NEM

And the challenge? It's only getting bigger. Today's energy planning is based on yesterday's demand forecasts. But the world is moving fast. AI-driven data centres and more are all adding massive new loads to the grid.

By 2030, data centres alone could consume between 8%5 and 12%6 of the National Electricity Market's (NEM) grid supplied electricity. That's up from 5% in 2024. In Western Sydney, New South Wales alone, data centre projects under construction could add more than 2 GW7 of new load roughly equivalent to two large aluminium smelters.

Federal investment plays a crucial role in underwriting the market and de-risking projects to enable private investment deployment. However, without significant participation from private capital, the investment gap and corresponding solution gap will persist.

BARRIERS TO PRIVATE INVESTMENT: A SYSTEM UNDER STRAIN

The energy transition is being stifled by a range of structural and economic barriers including:

Project Viability

Australia's transmission investments span one of the world's largest landmasses, supported by a relatively small population. The outcome? Exceptionally high unit costs, making electricity transport far more expensive than in most markets.

Add to this Australia's globally high tax rates and shifting tax policies. Investors face not only complex market dynamics but also evolving regulatory challenges.

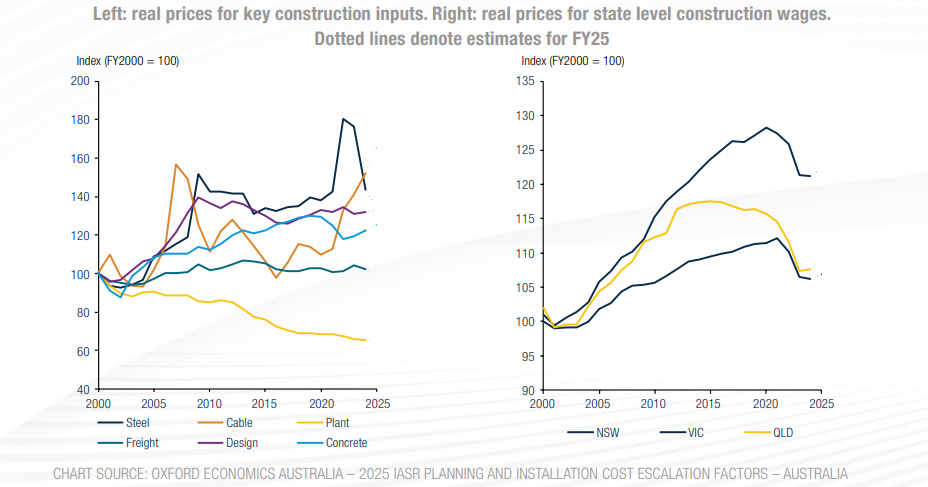

Skilled labour shortages further complicate matters, delaying critical infrastructure projects and driving up costs. Then there's the issue of contracted revenue and Power Purchase Agreements (PPAs), which lock in pricing for 10+ years. Predicting pricing and managing cost recovery over such long horizons is risky, especially with razor-thin margins.

Projects focussed on standalone generation solutions without storage are also increasingly exposed due to the intermittent nature of renewable energy. Without storage, it's difficult to balance supply and demand or orchestrate dispatch to take advantage of price fluctuations through energy arbitrage. Projects that include storage are essential to ensure reliable dispatch and optimise project economics.

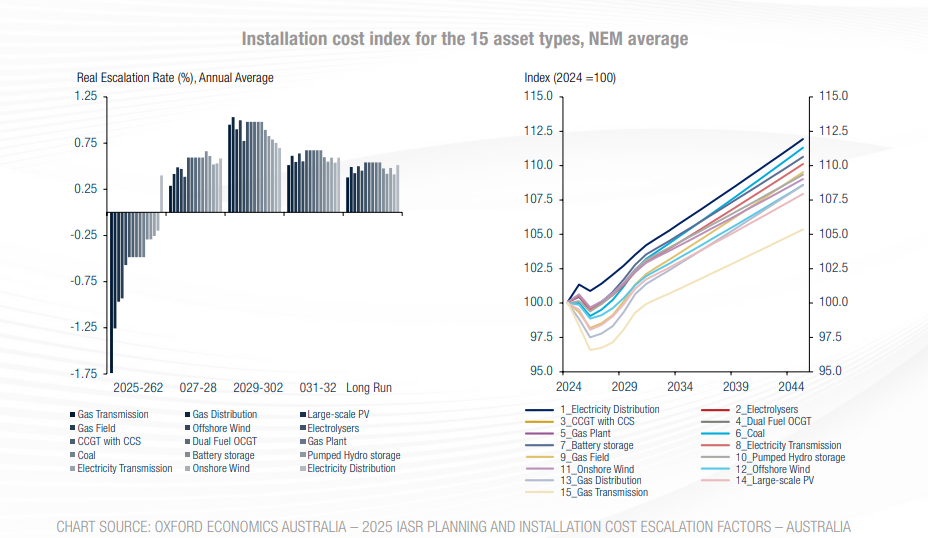

Several renewable energy projects around the world and in Australia are now underperforming against their business case - which may have be assuming between 11-20% returns8.

Planning and Installation Cost Escalation Factors – Australia

Infrastructure Bottlenecks

Transmission infrastructure and grid access are not keeping pace with the renewable development pipeline, creating bottlenecks that threaten to derail projects. Social licence, land access and public opposition to new transmission projects further complicate the issue.

Market Volatility and Curtailment Risks

Whilst the necessary transmission is being built, network stability risks are putting pressure on renewable energy projects. Generation assets face challenges such as curtailment and market price volatility which impact their economic viability and investment attractiveness.

Regulatory Complexity

Inconsistent regulation variability across states and between federal and state governments create uncertainty, making it difficult for investors to plan long-term projects. Renewable Energy Zones, for instance, have varying requirements across states, complicating compliance and investment strategies. Approval strategies. Environmental and grid connection delays are another significant hurdle; between 2018 and 2023, the approval rate for large-scale wind and solar projects dropped by 75% due to lengthy and complex environmental and planning processes.

Footnotes

1 https://cleanenergycouncil.org.au/news-resources/clean-energy-australia-report-2025

3 https://treasury.gov.au/policy-topics/future-made-australia

6 https://theenergy.co/article/aemo-doubles-data-centre-demand-forecast

7 https://www.dentons.com/en/insights/articles/2025/july/3/powering-australias-data-centre-boom

To view the full article click here

Originally published 15 October 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.