![]() ,

Ray Luchkow

,

Ray Luchkow ![]() and

Frédéric Bouchard

and

Frédéric Bouchard ![]()

Canada

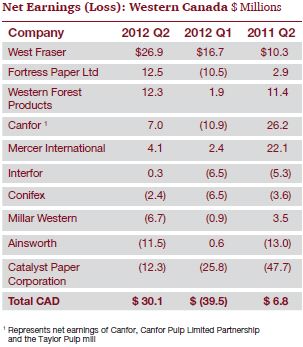

The 2012 second quarter net earnings reports for the Canadian forest and paper companies show a distinct quarter to quarter change in fortunes between the Western and Eastern based companies. The lumber and solid wood segment of the industry is experiencing slow but steady improvements, based primarily on the gradually improving US housing market. Northern Bleached Softwood Pulp (NSBK) prices continued to decline from the record highs reached in Q2 2011.

Western Canadian based companies posted net earnings of $30.1 million compared with net losses of $39.5 million in the first quarter of 2012 and net earnings of $6.8 million in the second quarter of 2011. West Fraser reported the highest net earnings for the quarter of $26.9 million compared to earnings of $16.7 million in the first quarter. Catalyst Paper Corporation reported net losses of $12.3 million for the quarter, an improvement from losses of $25.8 million in Q1 of 2012 and losses of $47.7 million in Q2 of 2011. Catalyst Paper Corporation is currently restructuring its financial affairs through the Companies' Creditors Arrangement Act (CCAA).

Eastern Canadian based companies posted net losses of $58.3 million compared to net earnings of $31.2 million for the first quarter of 2012 and net earnings of $185.2 million in the second quarter of 2011. Cascades reported net earnings of $7.0 million for the second quarter, while Resolute Forest Products reported a net loss of $65.7 million compared to net earnings of $33.0 million in the first quarter of 2012. Resolute recorded $88 million of closure costs, impairment and other related charges related to the indefinite idling of the company's Mersey newsprint mill.

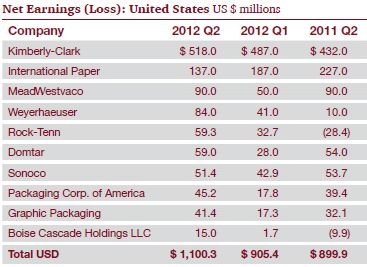

United States

Ten of the largest US-based forest and paper companies reported net earnings of US $1.1 billion for the second quarter of 2012, down from US $905.4 million in the second quarter of 2012 and US $899.9 million in the second quarter of 2011. Kimberly-Clark reported another strong quarter with net income of US $518.0 million, up from US $487.0 million in the first quarter of 2012. As a producer of tissue products, Kimberly-Clark sources all their pulp from external suppliers. Gross margins were positively influenced by the decrease in the price of pulp in the second quarter.

Europe

Ten of the largest European based forest and paper companies reported overall earnings of €482.6 million for the first quarter of 2012, up from earnings of €477.7 million in the first quarter of 2012, but down from earnings of €696.1 million in the second quarter of 2011. Earnings in the second quarter have been affected by the debt crisis in Europe and weak demand for newsprint and magazine paper in Europe and Australasia.

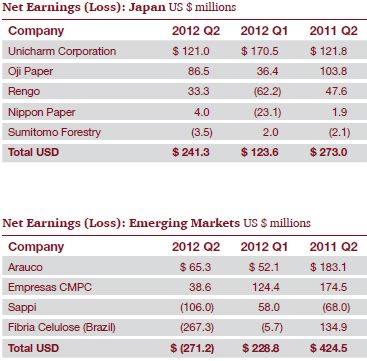

Rest of the World: Japan and Emerging Markets

Five of the largest forest and paper companies in Japan posted net earnings of US $241.3 million in the second quarter of 2012, up from US $123.6 million in the first quarter of 2012 but down from net earnings of US $273.0 million in the same period of 2011. The Japanese forest and paper industry continues to slowly improve from the disruption to operations from the March 2011 earthquake and tsunami.

Four of the largest forest and paper companies in emerging markets reported net losses of US $271.2 million in the second quarter of 2012, compared to net earnings of US $228.8 million in the first quarter of 2012 and US $424.5 million in the second quarter of 2011. Fibria Celulose reported net losses of US $267.3 million for the quarter, partially due to the effect of US dollar appreciation against the Brazilian Real on Fibria's US dollar denominated debt. Fibria's free cash flow generation was positive US $30.1 million for the quarter.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.