- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Oil & Gas industries

- within Corporate/Commercial Law, Immigration and Strategy topic(s)

Focusing on decision-useful information.

To make the right decisions, investors need the right information at the right time. So when preparing reports under IFRS® Sustainability Disclosure Standards, you need to provide sustainability-related information that is clear, structured and decision-useful. However, you may face challenges in determining which information to report.

"As Hong Kong adopts global sustainability standards, materiality ensures ESG disclosures are focused, relevant and impactful for investors - Eddie Ng - KPMG ASPAC Corporate and Sustainability (CSR) and ESG Assurance Topic Team Leader, KPMG China"

Materiality assessment

The concept of materiality aims to help you focus on providing decision-useful information to your investors. It determines the volume, type and precision of information you report.

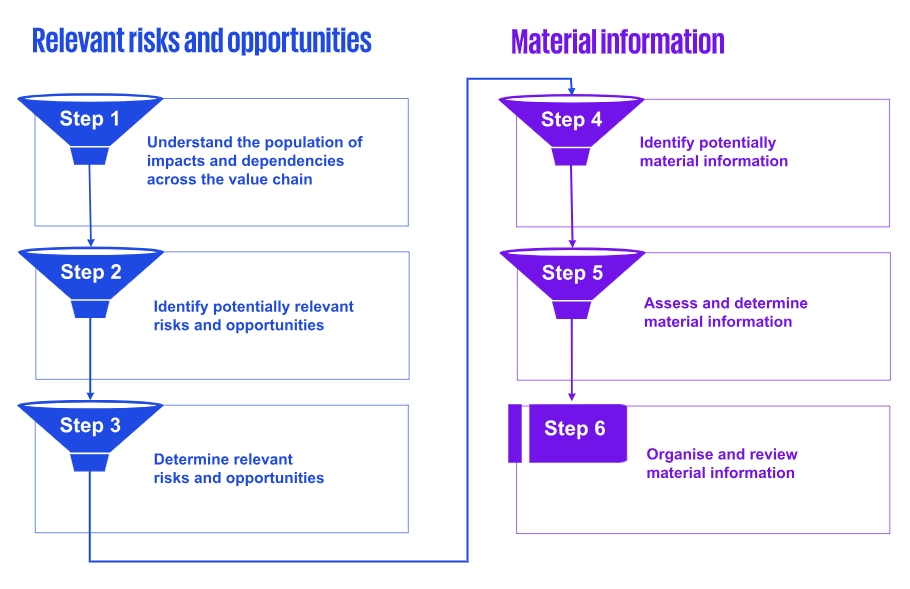

Six steps to guide your analysis

Follow the six steps in our new how-to guide – with practical insights and examples – that will help you provide the sustainability-related information your investors need.

The process starts with the value chain – including the company's business model and external environment. The six steps focus on how to filter out first the relevant risks and opportunities and then the material information investors need.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.