- within Technology topic(s)

- in United States

- within Technology topic(s)

Four strategic decisions that helped 'Differon' turn technology differentiation into stronger revenue and margins

"Engineering excellence and strong customer relationships had kept us ahead for decades. But these no longer guaranteed an edge. Data, software, and AI had become the main levers of differentiation, profitability, and growth. We had to rethink not just what we built, but how we competed."

This statement captures a turning point for 'Differon'. With margins under pressure and digitally native competitors moving fast, traditional moats could disappear overnight. The established business model and product-plus-service innovation were no longer enough. Differon realized it needed to redefine its competitive approach to stay ahead.

A key part of what Differon did right was precisely aligning technology differentiation and IP with commercial objectives. The company managed a complex technology stack with clarity and internal alignment, knowing where to differentiate, where to partner, and where to buy. At the same time, they secured IP choke points, negotiated advantageous data access, and ensured interoperability with larger systems without giving away domain expertise.

In any business play, only a few technologies or data assets are disproportionately important. Knowing which they are, having the capability to act on that knowledge, and aligning the organization's decisions around them makes a material difference. It certainly did for Differon.

Exhibit 1

Examples of companies that turned tech differentiation into growth and profit

Differon: From Engineering Excellence to Digital Leadership

Differon is a manufacturer of high-performance industrial process equipment, historically focused on equipment sales and service contracts. Its offering centers on modular systems of hardware and software ("Differon Modules") that integrate into customer production environments. Each module is engineered to specific requirements and can perform multiple functions across production lines.

The company was entering a period of rapid change. The rise of smart, data-driven solutions created both competitive pressure and new possibilities. The transformation was championed by the Chief Technology Officer, who assembled a dedicated team led by an entrepreneurial product owner and supported by the company's top strategic and technical talent.

Their vision was ambitious: to codify Differon's deep domain expertise into software and deliver data-driven services built on that foundation. These services were designed to optimize the performance of Differon's equipment and the broader production systems in which they operated, creating measurable gains in efficiency, reliability, asset longevity, and environmental performance.

A Synthetic Case from Real-world Experience

This article is based on a synthetic case that draws on Konsert's experience from recent Tech Differentiation Strategy projects with industrial clients. The insights are grounded in actual work, but all details have been anonymized and combined into a single, fictional case: Differon.

Defining Moments for Differon's Tech Differentiation Strategy

Realizing Differon's vision – to codify its domain expertise into digital services that optimizes the performance of Differon Modules and the broader production systems in which they operate – required close collaboration with system integrators, platform providers, third-party software companies, and customers. It also meant navigating friction and power dynamics within that ecosystem.

Differon's ability to win in these complex environments shared one common foundation: the creation and execution of a Tech Differentiation Strategy. It provided a shared taxonomy and a common canvas for strategic dialogue and decision-making. Most importantly, it enabled coordinated action across commercial, technology, data, and legal domains.

As the company began to execute its new approach, a series of defining moments put its emerging Tech Differentiation Strategy to the test.

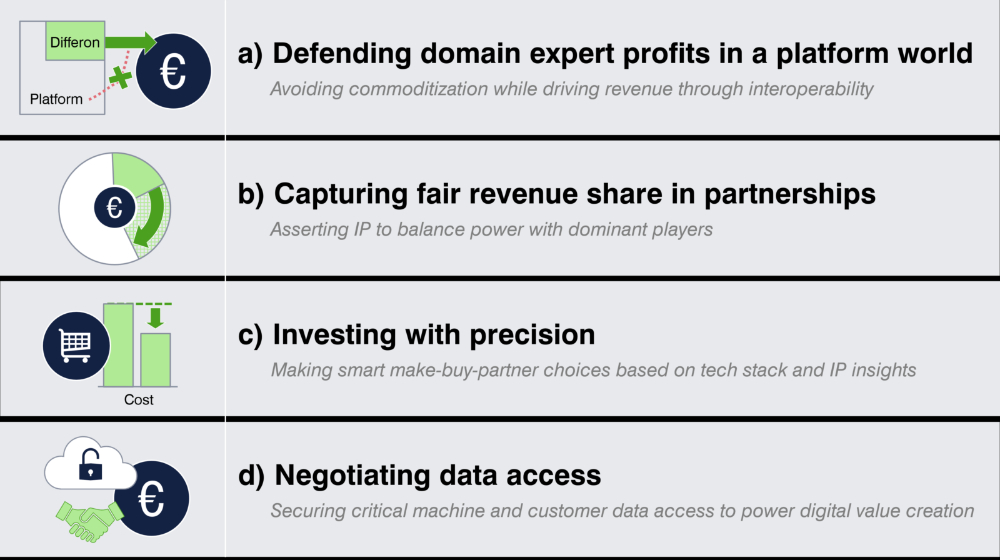

a) Defending domain-expert profits in a platform world. As platform players expanded into the industrial ecosystem, Differon avoided commoditization by ensuring its digital tools remained interoperable yet indispensable, turning its deep domain expertise into recurring high-value revenue.

b) Capturing fair revenue shares in partnerships. When a dominant software player sought to claim most of the value in a joint solution, Differon used targeted patents to assert control over critical performance choke points and secure an equal share of revenues.

c) Investing with precision. Facing time-to-market pressure and capability gaps, Differon made deliberate make–buy–partner choices based on technology and IP insights, accelerating innovation while avoiding costly missteps.

d) Negotiating data access. To power its digital services, Differon needed real-time data from third-party machinery. Through structured data negotiations, it secured access that created value for customers, machine makers, and Differon alike. It also helped establish Differon's position as a credible software and data partner.

Exhibit 2

Four defining moments, each presenting a distinct competitive situation

a) Defending domain expert profits in a platform world

– avoiding commoditization while driving revenue through interoperability

As Differon began developing digital services, the company faced competition from two new types of platform players: platform-powered industry leaders like Honeywell and Rockwell Automation, who are integrating their own digital stacks and acting as direct competitors; and data/technology platform partners such as AWS, C3.ai, and Palantir, who offer valuable capabilities but also introduce risks of value capture shifts and knowledge leakage in the industry. To succeed, Differon needed to maintain a defensible edge while staying interoperable within these broader ecosystems.

A central risk lay in the source of Differon's differentiation: its domain expertise. Turning that expertise into software and data meant codifying proprietary, often tacit, knowledge. Once embedded in digital services, this know-how risked being exposed and replicated by larger players. The company faced the threat of commoditization and being pushed out of high-value, high-margin positions in the value chain.

To avoid this, Differon's Tech Differentiation Strategy guided deliberate choices on how to remain a vital plug-in partner rather than a replaceable component. The strategy defined where in the tech stack to invest for differentiation, such as module-specific data ontology, root-cause fault prediction, and near-module system performance diagnostics. It also outlined where to ensure seamless interoperability with larger platforms, including connectors and APIs, application deployment, and edge event management.

These choices reinforced Differon's value-adding role in ecosystem negotiations with both customers and system players. Even dominant partners recognized the advantage of Differon's digital tools, which integrated smoothly into existing environments and provided distinctive value. With clear positioning and protected intellectual property, Differon became an indispensable contributor within the platform ecosystem. As a result, the company began to unlock recurring revenue streams at higher price points for its data-driven optimization and asset life-cycle services – rooted firmly in its domain expertise.

b) Capturing fair revenue share in partnerships

– asserting IP to balance power with dominant players

To accelerate its pivot to data-driven offerings, Differon identified the need to collaborate with one of a few major software providers specializing in production management and process control integration. A shortlist of potential partners was drawn up, and after initial discussions, one stood out as the clear favorite.

As negotiations progressed, it became clear that the dominant player intended to capture the majority of the value. Early proposals suggested a 20/80 revenue split in favor of the larger partner.

Anticipating this dynamic, Differon proactively created around ten patent applications covering key building blocks, such as module-specific data models, digital presetting and calibration, and module lifetime analysis, as well as the overarching system architecture that connected them, including integration of near-module controls with plant-level systems. Together, these filings formed an IP portfolio that covered the choke points essential to superior performance in the joint solution.

Armed with this foundation, Differon challenged the default assumptions in negotiations, stating confidently: "We control the choke points. Without us, this doesn't work."

The result was an approximately equal revenue split despite the partner's scale and larger patent portfolio. More importantly, the IP-backed position reshaped the partnership dynamic. The dominant player recognized Differon's unique value and became a more committed development partner, allocating additional R&D resources to the joint solution.

c) Investing with precision

– making smart make-buy-partner choices based on tech stack and IP insights

Guided by a granular understanding of its technology stack, Differon applied a structured Make–Buy–Partner roadmap. The company prioritized R&D in areas where its core competencies provided a true competitive edge, such as optimizing system performance based on Differon module data, while expanding its capabilities and differentiation potential through targeted M&A and strategic partnerships.

M&A and partnership decisions were informed by IP analyses that signaled innovation intensity and defensibility in key technology areas. This approach helped address time-to-market pressures, bridge capability gaps, and reduce technical uncertainty, while avoiding unnecessary reinvention or poor-fit acquisitions.

For example, to strengthen its sensing capabilities that were critical for predictive maintenance and performance intelligence, Differon acquired a European specialist with proprietary sensor technology and deep expertise in material science. The acquisition accelerated the product roadmap by roughly 12 months and added a highly skilled workforce, unique technical assets, and competences that competitors could not easily replicate.

In another case, to enhance cognitive analytics for real-time decision support and adaptive system behavior, Differon partnered with a leading US-based software provider. Instead of building these capabilities in-house, Differon integrated the partner's proven analytics modules into its offering. The move avoided millions in upfront development and recruitment costs and enabled smarter automation across diverse customer environments.

d) Negotiating data access

– Securing critical machine & customer data access to power digital value creation

While the first three moments focused on technology and the competitive situations surrounding it, Differon's success increasingly depended on access to data. In many cases, data proved as critical as the technology itself.

Both Differon's system performance services and its energy and CO₂ reduction offerings depended on real-time data from process control systems embedded in third-party machinery. However, equipment manufacturers were often reluctant to grant access to this data, creating friction and uncertainty that threatened to delay or derail the planned digital services for system performance and sustainability.

Differon responded with a structured approach to data negotiations. The goal was not to claim ownership of the data, but to guarantee consistent, secure, and timely access. Granularity was essential. The company developed a detailed understanding of which data streams were needed and how they would be accessed and consumed. Ultimately, the resulting access arrangements proved mutually beneficial. Customers gained more value from their equipment, machine makers benefited as those customers leveraged their machines more effectively, and Differon's digital services could deliver their intended impact.

By successfully navigating these negotiations, Differon also began to shift market perceptions. Once viewed primarily as a hardware provider, the company established itself as a credible software and data player. Its ability to engage confidently in data partnerships secured customer trust, improved market acceptance, and reinforced Differon's position in the emerging industrial ecosystem.

When Differentiation Becomes Strategy – the Real-World Impact

Differon's story reflects patterns we have seen across multiple real-world companies. Each faced growing digital competition, pressure on margins, and a need to redefine how technology creates advantage. By developing and executing a clear Tech Differentiation Strategy, they achieved measurable business results.

- Shift to managed services: One company moved from billable hours to a high-margin managed-services model, realizing customer cost saving and capturing a large share of a value pool worth about €500 million.

- Software-driven valuation lift: Another increased the software share of total revenue, reshaping market perception and adding billions of euros in enterprise value.

- Outcome as a Service. A third client countered an imminent commoditization threat by introducing an Outcome as a Service model that protected a €3 billion legacy business against new entrants.

- Right to play with proprietary analytics: A fourth company doubled down on its applied analytics capabilities, securing its market position by proving unique value that neither customers nor competitors could match.

For these companies, Tech Differentiation Strategy became more than a framework. It evolved into a way of running the business, linking technology, data, and IP decisions directly to commercial goals. It gave leadership teams a shared language and a clear canvas for deciding where to invest, how to partner, and what to protect. Most importantly, it enabled coordinated action across commercial, technology, data, and IP domains, turning differentiation into results that showed up in euros and cents.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.