- within Government and Public Sector topic(s)

- in Asia

- in Asia

- with readers working within the Media & Information industries

- within Government, Public Sector, Coronavirus (COVID-19) and Environment topic(s)

As climate change, geopolitical instability, cyber threats and surging demand place more pressure on infrastructure, governments, investors and operators must rethink what it means for assets to be truly resilient.

Our Resilient Infrastructure series will explore the legal and commercial considerations for building resilience into existing and new infrastructure. The series will examine the role of regulation and private finance, and the risk in outdated assumptions about asset longevity.

No-one plans for infrastructure to fail. Infrastructure assets provide the critical public networks and services that underpin our economies and communities. Yet, around the world, infrastructure is ageing and being put under stress beyond what it has been designed to withstand.

This strain is compounded by rising demand, driven by population growth, urbanisation and evolving usage patterns that accelerate wear and tear. Infrastructure that was never intended to stand up to today's volumes or conditions is increasingly at risk of failure.

The designers of California's power grid would have never expected ageing transmission lines and drought to cause the 2018 Camp Fire, the deadliest and most destructive wildfire in the state's history.1 The architects of the Panama Canal could not have predicted how El Niño would cause the water level to fall and delay global trade in 2023.2

In New South Wales, Australia, governments have had to commit more than A$4 billion over the past three years to rebuild roads and other infrastructure damaged by flooding.3Authorities in France and Switzerland have recently been forced to temporarily halt or slow activity at nuclear power plants as heatwaves have raised water temperatures.

If you own or operate an infrastructure asset that is not resilient to climate risks and something goes wrong, you're looking at significant financial losses, disputes, class actions or even regulatory intervention."

The list goes on. Climate change and increasing demand are testing the limits of public infrastructure, requiring governments and investors to bolster existing assets and expand their expectations of new projects.

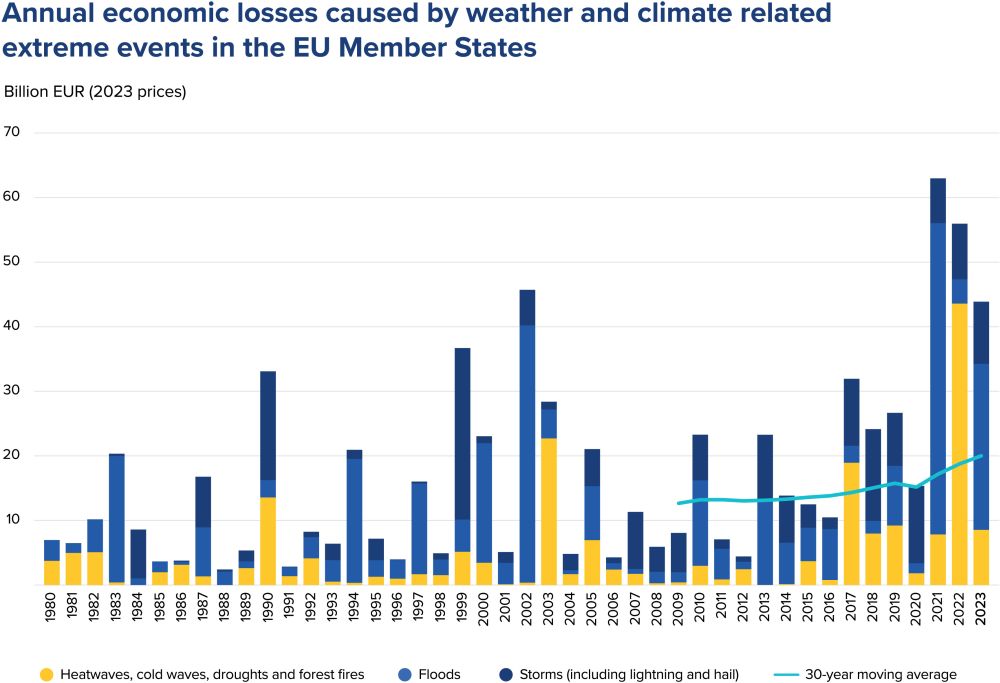

As well as incorporating resilience into existing and new conventional infrastructure assets, novel types of infrastructure will be needed to address some of the effects of climate change, such flood defences to protect against rising sea levels. The following chart from the European Environment Agency shows an unmistakable trend in the cumulative negative economic effects of storms, floods and heatwaves in the EU.4

Source: European Environment Agency.

Rebalancing risk in a changing world

Providers of private capital and project finance have a key role to play in delivering this new or upgraded infrastructure for tomorrow. But all stakeholders – governments, owners, developers, lenders, operators, contractors and insurers – will need to agree how to allocate risk.

Stakeholders who overlook downside scenarios in pursuit of more favourable terms may be exposing themselves to avoidable risks. These scenarios increasingly include not only climate-related events but also cyberattacks and sabotage.

Owners and operators that are not realistic about the durability of existing assets may find they can't meet their obligations to users. This includes underestimating the long-term performance requirements of assets in high-demand environments.

As usage intensifies, so does the risk of failure, especially where maintenance and upgrade cycles have not kept pace. Moreover, governments will be expected to step in if privately owned assets such as communication or utility networks or critical transport assets fail.

In certain locations, insurance costs are becoming uneconomical or stakeholders are finding that assets are uninsurable. Failures can also expose owners to class actions and other claims, whether for personal injury or business interruption. Large losses could in turn lead to insolvencies or the (re)nationalisation of assets.

Nicholas Carney, Herbert Smith Freehills Kramer's Global Co-Head of Infrastructure, notes, "If you own or operate an infrastructure asset that is not resilient to climate risks and something goes wrong, you're looking at significant financial losses, disputes, class actions or even regulatory intervention."

The market is quite good at designing funding models that get infrastructure built and running. It is less effective at embedding the renewals required to keep it in good shape over the long term."

A measured approach for the private sector

Fortunately, these risks can be minimised by making infrastructure more resilient. A range of potential mechanisms is available for achieving this goal.

Governments planning to upgrade essential infrastructure or replace it can consider the role of private finance. Incentives, or disincentives, can be engineered into contracts so that resilience is a priority and partners are motivated to deliver infrastructure that lasts.

Contracts and financing models must also account for lifecycle performance, ensuring that infrastructure is not only built to last but also adaptable to future pressures. This means embedding durability and scalability into design, funding models and operational planning.

"We're quite good at designing funding models that get infrastructure built and running," says Gavin Williams, Herbert Smith Freehills Kramer's Global Co-Head of Infrastructure. "We're less good at embedding the renewals required to keep it in good shape over the long term."

Priorities for policymakers

To improve the chances of infrastructure withstanding future pressures – whether from climate conflict, demands or capacity pressures, policymakers should focus on three key actions:

- auditing existing asset portfolios for climate vulnerability

- updating planning and construction standards to reflect modern resilience requirements

- embedding resilience metrics into procurement, funding and regulatory frameworks.

These steps will help ensure public infrastructure remains safe, functional and financially viable in the decades ahead.

Partners in planning for resilience

Infrastructure providers hold an important social licence, so it is not surprising that there are significant consequences when they fail to meet expectations. This seems likely to occur more often as climate change gathers pace, user demand shifts, geopolitical instability grows and assets age.

Owners, investors, contractors and operators that are prepared today will fare better in the future. To help inform this work, our articles will explore a range of factors, legal and commercial, relevant to making infrastructure more resilient.

Footnotes

1. https://www.preventionweb.net/news/usa-cal-fire-investigators-determine-cause-camp-fire

4. https://www.eea.europa.eu/en/analysis/indicators/economic-losses-from-climate-related

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.