At a glance

AlixPartners' inaugural survey of beverage executives reveals an industry focused on driving productivity in the face of supply chain pressures, rising input and labor costs, and the uncertainties created by tariffs, trade policy and evolving consumer preferences.

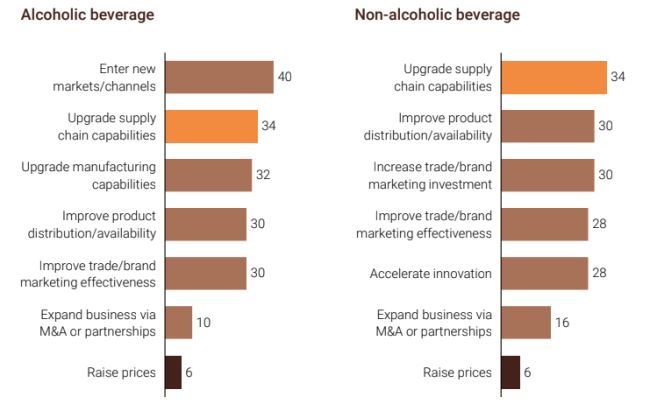

Supply chain resiliency has made it to the top of the priority list to drive revenue growth for both alcohol and non-alcohol beverage companies, matching the importance of more traditional growth levers, such as entering new markets or extending product distribution.

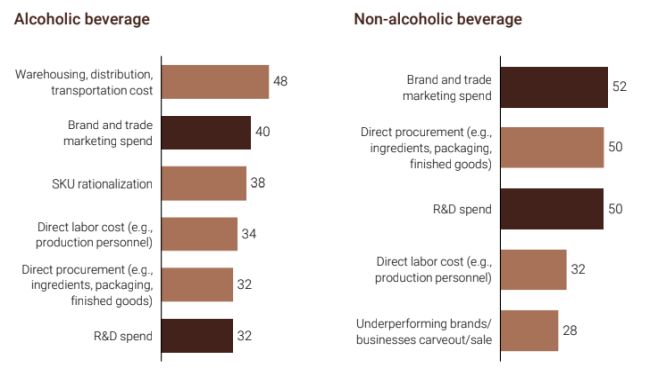

Executives in both market segments told us that the productivity push extends beyond the supply chain. Tackling brand, trade, and R&D spending was ranked as a leading driver of cost improvement.

There is a tacit recognition across the industry of the limited leeway to push harder on price, which ranked at the bottom of their priorities. That only adds to the pressure to deliver productivity improvements in pursuit of profitable growth.

Still, the drivers of the productivity push diverge between the sectors.

Executives in the non-alcoholic space are more confident about their companies' performance and prospects. Consumer megatrends favoring better-for-you products and those with functional benefits present tremendous opportunities for new entrants and established players. Executives are looking to productivity to free up resources for marketing and innovation in breakthrough sports, energy, and functional drinks.

In contrast, the same societal shifts away from alcohol consumption place its beverage suppliers in a different situation. Their drive for productivity appears to be more about maintaining margins. They place investing in marketing and innovation well down their priorities list, focusing instead on "blocking and tackling" investments to enter new markets and channels.

Unpacking the findings – areas of convergence

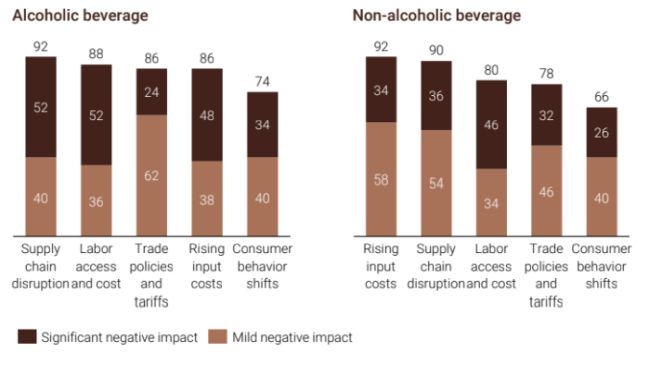

The most disruptive factors facing executives are trade policy and material and labor costs, which ranked even above the shifts in consumer behavior.

That makes upgrading supply chain capabilities a top priority to drive growth in both beverage aisles.

Enhancing supply chain capabilities enables companies to shift between products and categories in response to evolving consumer demands. However, tackling volatile input prices, tariffs, and workforce shortages are the immediate priority for executives.

Rate external factors based on the impact to your business

In the next 12 months, what will be the top three priorities to drive revenue growth in your business? (%)

Cost pressures abound. Manufacturing labor costs increased by 11% between July 2023 and July 2025, according to government data. Packaging costs have climbed even further, according to company reports.

Aluminum accounts for approximately one- third of the cost of a drink can, and imports of

the metal account for nearly half of U.S. consumption. Prices have risen 30% since the start of 2025 and are projected to climb further as the full impact of tariffs is passed through.

Commodities such as cocoa, coffee, citrus crops, corn, barley, and sugar have also been subject to considerable price and supply volatility. Production equipment, much of it sourced from Europe, is also affected by fresh levies that have disrupted investment plans.

Surging expenses in transportation, aluminum cans, and crops have significantly impacted production budgets over the past year

Boosting productivity in brand, trade, and R&D spending ranks among the top priorities for cost improvement, particularly for executives in non-alcoholic beverage.

In the next 12 months, what will be the top three priorities to drive cost improvement in your business?

Companies including AB InBev, Molson Coors, Constellation Brands, and PepsiCo, have succeeded at reducing or keeping flat marketing spending as a percentage of net revenue in recent years. All recognize significant opportunities to improve targeting. Our clients are placing more emphasis on enforcing ROI measurement and accountability, strengthening smart data-driven marketing spending, and improving spend effectiveness and efficiency in both beverage sectors.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.