- within Antitrust/Competition Law, Wealth Management and Tax topic(s)

- in United States

- with readers working within the Banking & Credit industries

DAMITT, the Dechert Antitrust Merger Investigation Timing Tracker, is the leading source of analysis for significant U.S. and EU antitrust merger investigation and litigation trends. In this report, we discuss the average duration of U.S. merger investigations and its impact on dealmakers. We also evaluate conflicting signals on Phase I remedies amid muted EU merger activity.

Key Facts

United States

- Only two significant U.S. merger investigations concluded in Q3 2025, a sharp decline from the second quarter. The agencies are on pace for another year with a historically low number of significant merger investigations.

- The U.S. agencies issued their second closing statement this year after zero were issued during the Biden Administration, helping to provide greater transparency regarding enforcement decisions.

- The average duration of U.S. significant merger investigations for 2025 YTD is 12.7 months, an increase of more than a month compared to 2024.

European Union

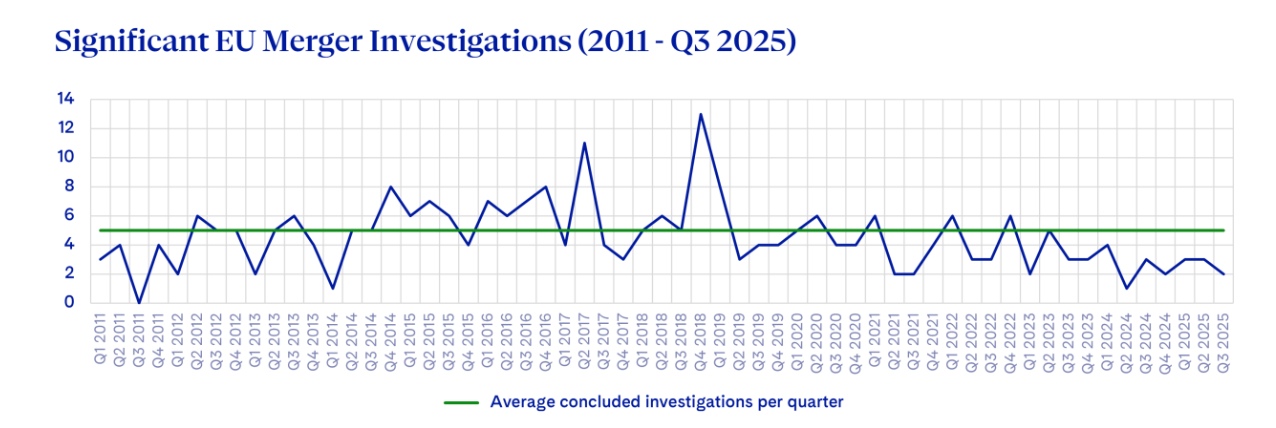

- Two significant EU merger investigations concluded in Q3 2025.

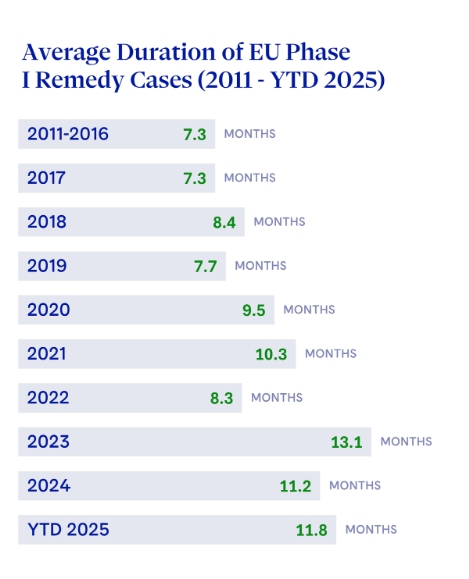

- Contradicting signals re: the duration of Phase I remedy cases, with both the shortest and one of the longest reviews recorded in Q3.

- Behavioral remedies are making a modest comeback.

United States

Q3 2025 Records Lowest Significant U.S. Merger Investigation Activity of the Year

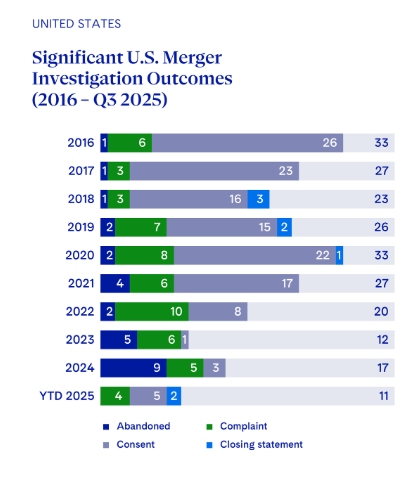

Only two significant U.S. merger investigations concluded in Q3 2025—a significant decline from the six in the prior quarter.

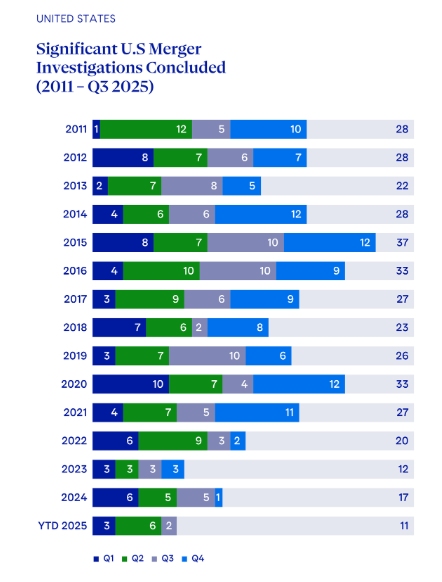

The Q3 2025 total is also significantly lower than the average number of investigations for third quarters historically between 2011-2024 (5.9 on average). Through the third quarter, just 11 significant investigations have concluded—well below both the average of 18.1 completed by the end of the third quarter going back to 2011, as well as the 18 recorded during the first year of the first Trump Administration.

To match the 2024 total, the agencies must complete six significant investigations in the fourth quarter. Historically, the last quarter of the year is the busiest for the U.S. antitrust agencies (7.6 on average, 2011-2024). However, hitting the long-run annual average of 25.8 significant merger investigations, or the first Trump Administration's pace (27.3 on average between 2017-2020), would require a sharp surge in the fourth quarter.

Last month, the agencies released the HSR Annual Report for fiscal year 2024 (October 1, 2023–September 30, 2024). Although DAMITT remains four quarters more current, the agencies' report nonetheless provides interesting insights for the business community and the antitrust bar. For starters, 47% of transactions valued over $10 billion received second requests (8 out of 17 in total), though such deals comprised under 1% of all reported transactions. Overall, the agencies issued second requests in 3% of reported transactions, an uptick from the earlier lull during a significant period of the Biden Administration. Lastly, the agencies counted 26 transactions as abandoned or restructured. DOJ distinguished restructurings from abandonments, but the FTC did not. As noted in prior DAMITT Reports, the lack of detail creates difficulties in interpreting these totals over time.

DOJ Takes a Targeted Approach to Merger Enforcement in the Third Quarter

After last quarter's flurry of pre-complaint settlements, the third quarter was comparatively quiet with only one FTC complaint and one DOJ closing statement, which is a tool the FTC revived last quarter after the Biden Administration issued none. Closing statements can shed meaningful transparency on the agencies' approach to merger review by clarifying the factors that drive enforcement decisions.

The FTC's complaint seeks to block Edwards Lifesciences' proposed acquisition of rival medical device maker Jena Valve Technology. The FTC alleges the two companies are competing to bring to market a "revolutionary" heart condition device.

In DOJ's T-Mobile/UScellular closing statement, Assistant Attorney General (AAG) Gail Slater acknowledged concerns about potential harm to "Heartland Families" and "Farmtown Frugals" who valued UScellular's locally tailored mobile wireless services. Nevertheless, DOJ found UScellular's "limited regional footprint" and inability to invest would "lead to a slow degradation of it network quality" absent the deal. Coupled with T-Mobile's public commitment to provide UScellular's customers with faster data speeds and broader coverage in rural areas, DOJ concluded on balance that an enforcement action was not warranted.

In an encouraging sign for dealmakers, the closing statement suggests the current administration may place greater weight on the consumer benefits of a merger, including any concrete post-merger commitments by the acquirer. The agency also appears to have carefully factored in the allegedly weakened state of the selling company in assessing the merger's impact on future competition.

On the litigation front, DOJ entered into a post-complaint consent order to resolve DOJ's challenge to the UnitedHealth/Amedisys merger filed at the very end of the Biden Administration. DOJ touted the consent as "the largest divestiture of outpatient healthcare services" in history. The settlement also required Amedisys to pay a $1.1 million civil penalty and conduct antitrust compliance training to resolve allegations that its HSR filing certification was false with respect its document production.

Lastly, in Q3 2025, DOJ unconditionally dismissed its lawsuit to block American Express Global Business Travel's acquisition of CWT—the first unconditional withdrawal of a merger challenge in DAMITT history (2011-2025).DOJ filed this lawsuit in the final days of the Biden Administration. Although DOJ did not issue a formal explanation for its dismissal, AAG Slater later remarked "the Division must also consider the enforcement trade-offs inherent to thoughtful and effective use of its limited taxpayer-funded resources."

The Duration of Significant U.S. Merger Investigations on Pace to Remain at Historic High

The latest data on the average duration of significant merger investigations remains discouraging for dealmakers. The average duration of U.S. significant merger investigations was 13.1 months—slightly below the average duration of 13.6 months across the six investigations concluded in the prior quarter. The average duration for 2025 YTD is 12.7 months, more than a month longer than the 11.3-month average recorded in 2024.

If the current pace persists, the agencies would set a new record this year for the longest significant merger investigations in DAMITT's 15-year history. All significant investigations completed so far this year began during the prior administration, leaving hope that more recent transactions will follow a faster track going forward. But we do not yet have enough data to conclude whether the Trump Administration is accelerating reviews as previously signaled (see DAMITT Q1 2025 Report). In addition, the newly expanded HSR filing requirements could lengthen significant investigations by adding additional preparation time to the front end of merger reviews. Any trends emerging from these HSR changes will be picked up in future quarters.

European Union

Enforcement on the Rise: Two Phase I Clearances With Remedies, One In-Depth Investigation Opened, Several Transactions Under Scrutiny in Q3 2025

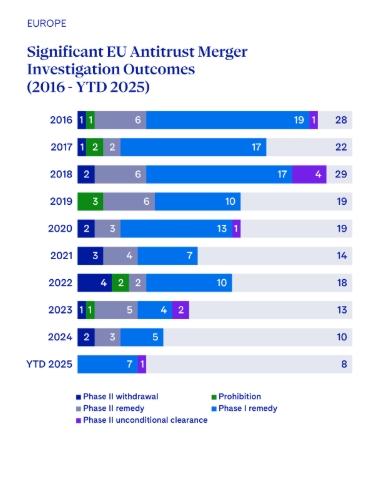

Two significant merger investigations were concluded by the EU Commission in Q3 2025: the acquisition of Boissons Heintz by Brasserie Nationale on 17 July 2025, and Naspers' acquisition of Just Eat Takeaway.com on 11 August 2025, both cleared in Phase I with remedies.

One Phase II investigation was opened during Q3 and is ongoing. It concerns the proposed acquisition of Downtown by Universal Music Group. At the same time, multiple open and still ongoing investigations are poised to feed into the merger-control pipeline: of the 94 notifications made to the EU Commission during the past three months, 6 investigations, i.e. approx. 6.4%, are being reviewed under the normal procedure, i.e. not the (super) simplified procedure. In total, to date, there are 301 ongoing Phase I and Phase II investigations.

Contradicting Signals Re: the Duration of Phase I Remedy Cases

The two Phase I with remedy decisions issued in Q3 2025 point in opposite directions on timing: an unusually rapid 2.8-month review period on the one hand, alongside a lengthy review on the other.

- Following announcement of the public bid on 19 May 2025, the

Naspers / Justy Eat Takeaway deal was cleared in just 2.8

months by the EU Commission, on 11 August 2025.

That is the shortest review period since August 2018, when the EU Commission cleared, subject to conditions, the acquisition of Wind Tre by Hutchison in only 2 months. Very few merger investigations ending with a Phase I remedy decision are reviewed that rapidly (only 5 below three months in the last 15 years).2 - By contrast, Brasserie Nationale / Boissons Heintz is the second investigation exceeding 19 months, with a 19.1 month review period from announcement to clearance, following 20.8 months in Safran / Collins Aerospace.

The Brasserie Nationale / Boissons Heintz deal was first announced to the Luxembourg competition authority on 22 December 2023 and 10 January 2024,3 upon which the Luxembourg competition authority made a referral request to the EU Commission which was challenged by the parties before the EU Court of Justice. The General Court confirmed that the EU Commission is in principle empowered to accept referral requests from Luxembourg under Article 22 EUMR, if the conditions for such referral are met, which was the case here. The General Court therefore confirmed the EU Commission's power to review the compatibility of Brasserie Nationale's acquisition of Boissons Heintz. As a result, the concentration, which had been notified to the EU Commission on 18October 2024, was subsequently withdrawn on 18November 2024. It was notified again on 26 May 2025.

Brasserie Nationale / Boissons Heintz is the second case in a row with a very long review period, following the Safran / Collins Aerospace case, which took an exceptional 20.8 months from announcement to clearance with conditions (the transaction involved two of the main suppliers in a market marked by high entry barriers and long contract cycles).4

These two consecutive exceptionally long review periods are keeping the average duration from announcement to clearance of EU Phase I remedy cases high, at 11.8 months in 2025 year-to-date (a minor decrease compared to the average of 12.1 months in 1H 20255). Excluding these two cases would bring the average down to 8.5 months, thus marking an improvement compared to the 2024 average of 11.2 months.6 This suggests that whilst a lengthy review period can be expected in exceptionally complex cases, the duration of other merger investigations is getting shorter.

A Modest Comeback of Behavioral Remedies

Behavioral remedies are making a modest comeback in EU merger control, as illustrated by the EU Commission's recent clearance of the Naspers / Just Eat Takeaway transaction. In parallel to significantly reducing its shareholding in Delivery Hero, below a specified very low percentage, within 12 months, Naspers offered to implement a set of additional commitments, for a specified time, namely (i) refrain from exercising any voting rights attached to its remaining limited shareholding in Delivery Hero; (ii) abstain from recommending, proposing or approving any person, whether engaged by Naspers or by any entity in which it holds an equity interest, for appointment to Delivery Hero's Management Board or Supervisory Board; and (iii) ensure that its equity interest in Delivery Hero never exceeds the specified maximum level.7

Supplementing structural remedies with targeted behavioral commitments contrasts with the predominantly divestiture-only remedies approach of recent years. This hybrid package underscores the EU Commission's willingness to deploy calibrated behavioral measures (alongside traditional structural remedies) where appropriate.

The last example of such combined approach was in case ALD / Leaseplan, cleared on 25 November 2022, and the last example of behavioral-only commitments was in case Siemens Healthineers / Varian Medical Systems, cleared on 19 February 2021.

EU Merger Guidelines Review: Next steps

The EU Commission's public consultation on the review of the merger guidelines, launched in Q2 2025,8 is now closed.The EU Commission received 27 responses9 to its Call for Evidence. All are now published. The EU Commission is currently analyzing these responses and will publish a summary of the main points and conclusions on its 'Have Your Say' portal and on DG Competition's website.

The economic study on the dynamic effects of mergers commissioned in parallel will also inform the review of the Merger Guidelines. This study aims to provide analytical foundations to assess whether a merger has a positive or negative impact on these dynamic factors, and analyze their relationship with static factors – such as changes in prices or output.

At a later stage, a stakeholders' workshop will be organized, and, subsequently, stakeholders will have the possibility to provide their views on a draft of the revised Merger Guidelines that the EU Commission will publish for comments. The results will feed into the ongoing review of the EU Merger Guidelines.

Adoption of the revised Merger Guidelines is planned for Q4 2027.10

Launch of an Investigation for Possible Breach of the Duty to Supply Correct Information

On 24 July 2025, the EU Commission opened a formal investigation for possible breach by the parties of the duty to supply correct information in the context of a transaction in the broadband infrastructure access services sector.

For background, on 30 May 2024, the EU Commission had unconditionally cleared the acquisition, concluding that the transaction would not raise competition concerns in the EEA. The EU Commission is now assessing whether the acquirer provided incorrect or misleading information about certain long-term broadband infrastructure access agreements entered into with several access seekers which were crucial to the assessment.

Interestingly, the EU Commission is launching this investigation more than a year after clearance was granted.

Notifications and information requests are the primary sources of information for the EU Commission when assessing notified mergers and acquisitions. Accuracy and completeness of information are therefore essential for an effective assessment, which is why parties can incur sanctions if they provide incorrect, incomplete or misleading information. They may receive a fine of up to 1% of their aggregate turnover,11 and/or the Commission may revoke the decision adopted based on incorrect information.12

Conclusion

Parties to transactions subject to significant merger investigations continue to face an elevated risk of seeing their deals blocked or abandoned on both sides of the Atlantic. To ensure the ability to defend their deals through a potential investigation, parties to the average "significant" deal in the U.S. should plan on up to 12 months for the agencies to investigate their transaction. Parties should also consider allocating an additional 6 to 12 months in their transaction agreements if they want to preserve their right to litigate an adverse agency decision, for a total of 18-24 months.

In Q3 2025, the European Commission concluded two high‐profile Phase I mergers with remedies, launched a Phase II investigation, and maintained a robust pipeline of almost 30 ongoing Phase I and II reviews, underscoring both rising enforcement activity and the growing unpredictability of remedy timelines. If parties plan on obtaining a Phase I clearance with commitments, they should be aware that the duration of the review period may vary extensively, depending on the complexity of their case.

Report Methodology

The Dechert Antitrust Merger Investigation Timing Tracker (DAMITT) is a quarterly study from Dechert LLP's Antitrust/Competition practice reporting on trends in significant merger control investigations in the United States (U.S.) and European Union (EU).

In the U.S., "significant" merger investigations include Hart-Scott-Rodino (HSR) Act reportable transactions for which the result of the investigation by the Federal Trade Commission (FTC) or the Antitrust Division of the Department of Justice (DOJ) is a consent order, a complaint challenging the transaction, an official closing statement by the reviewing antitrust agency, or the abandonment of the transaction with the antitrust agency issuing a press release.

In light of the procedural differences between the EU and U.S., DAMITT defines "significant" EU merger investigations to include transactions subject to the EU Merger Regulation (EUMR) and resulting in either a Phase I remedy or the initiation of a Phase Il investigation.

DAMITT calculates the durations of significant investigations in both jurisdictions from the deal announcement date through the completion of the investigation, and therefore includes the time attributable to pre-notification consultation efforts.

Footnotes

3 See https://paperjam.lu/article/nouvelle-evaluation-de-la-fusion-la-brasserie-nationale-deboutee

4 See DAMITT Q2 2025 report, available at: https://www.dechert.com/knowledge/publication/2025/7/damitt-q2-2025.html

5 See DAMITT Q2 2025 report, available at: https://www.dechert.com/knowledge/publication/2025/7/damitt-q2-2025.html

6 See DAMITT 2024 Annual Report, available at: https://www.dechert.com/knowledge/publication/2025/1/damitt-2024-annual-report.html

7 See EU Commission press release "Commission approves Naspers' acquisition of Just Eat Takeaway.com, subject to conditions", August 11, 2025, available at: https://ec.europa.eu/commission/presscorner/detail/en/ip_25_1951

8 See DAMITT Q2 2025 report, available at: https://www.dechert.com/knowledge/publication/2025/7/damitt-q2-2025.html

9 See https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/14596-Merger-guidelines-review_en

10 See https://competition-policy.ec.europa.eu/mergers/review-merger-guidelines_en

11 Pursuant to Article 14 paragraph 1 of the EUMR.

12 Pursuant to Article 6 paragraph 3 of the EUMR.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.