- with readers working within the Advertising & Public Relations and Healthcare industries

- within Law Department Performance, Environment and Energy and Natural Resources topic(s)

Every company faces financial realities related to employee turnover. It's just a part of doing business. The reasons for employee turnover can vary: employees might leave for promotions, more pay, better commute, culture, or they just think the grass is greener somewhere else, while employers might terminate employees because of a strategic reorganization, or for reasons such as an individual's poor performance or a violation of the company's code of conduct.

Regardless of the causes of employee turnover, savvy finance leaders and FP&A professionals recognize the enormous savings to an annual budget by planning for vacancy.

Vacancy is simply defined as the expenses a company does not spend while having open positions. These unfilled openings could come from employee turnover or new positions being filled later than their projected hire date, during which time the company is not spending money on compensation for the position.

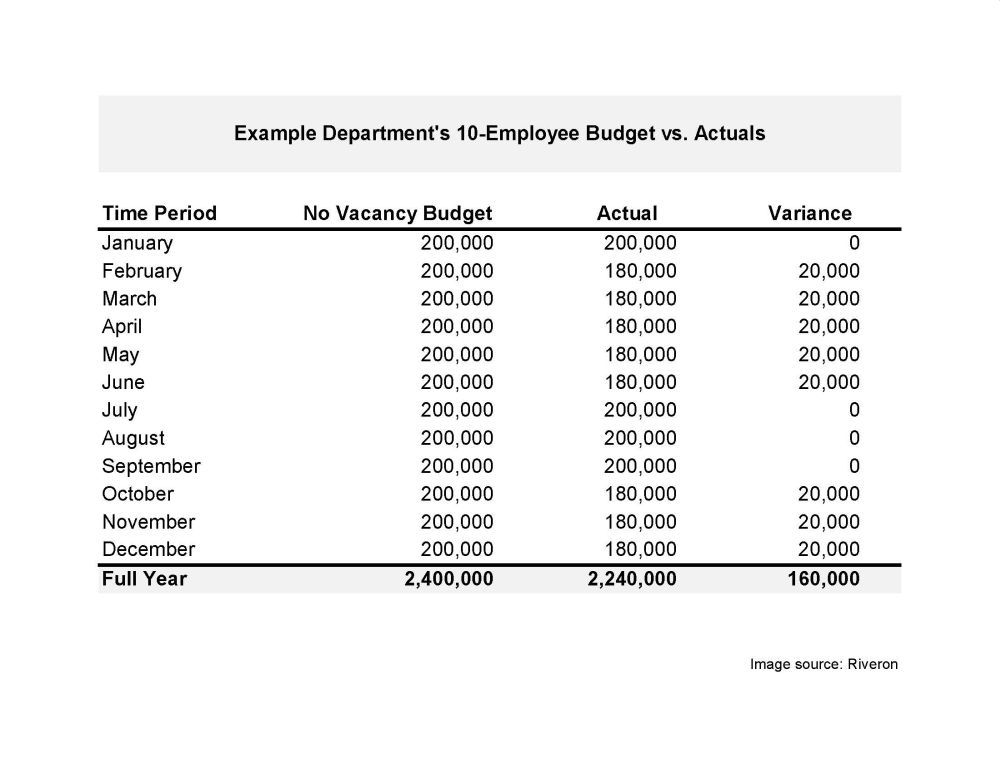

For example: Assume a department of 10 employees has an average annual base salary of $170K, 20% bonus, approximately $20K for payroll taxes, and $15K for annual benefits. So, the all-in or fully-loaded cost of an employee is $240K per year, or $20K per month.

Now, let's assume that one employee leaves on February 1, and the open position is filled on July 1. Another employee leaves on October 1, but the job opening is not filled during the same year.

In this example, the department's budget included an extra $160K compared to what was needed, and there's a high probability that the department manager would use those funds for other non-budgeted and non-approved expenses. This "excess" can ultimately lead to the company spending on non-budgeted items or not funding additional investments that can drive growth or greater efficiency. Department leaders tend to spend what they're allocated in the budget, so if a department is given a $2M budget, they'll likely spend the entire $2M; however, if introducing a a vacancy factor reduces their budget by $160K to $1.84M, the department is more likely to spend only $1.84M. This controlled spending can lead to greater overall company profitability or free up those $160K for other strategic growth initiatives.

By contrast, let's assume that another company has 400 employees and uses a 5% vacancy rate. The company would have $4.8M in lower compensation expenses in the budget—money that can be used to invest in growth, automation, or to increase EBITDA.

Although it's tempting to use a vacancy rate that is close to the actual rate, best practices recommend being more conservative by targeting a few percentage points below the actual rate to make sure the company doesn't go over budget.

How budgeting for vacancy results in real-world savings

Two real examples we've seen when vacancy was introduced to the budgeting process:

- Company A: $3B annual revenue company with 2,500 global employees had actual vacancy of 8.8% and used a 5% vacancy rate in their next year's budget. The result was a reduction of $22M in compensation expenses.

- Company B: $1B annual revenue company with an average of 7,000 full-time, part-time, and season employees had an actual vacancy rate of 7.5% and used a 5% vacancy rate in their next year's budget. The result was a reduction of $17M in compensation expenses.

Company-wide considerations: How FP&A leaders can encourage departments to get on board with vacancy rates

Rolling out any new budgetary approach can involve some initial pushback that can usually be resolved with clarifications. A key roadblock to keep in mind, when vacancy is first introduced, is that many departmental managers will object by saying, "What if I don't lose any employees within my department?"

The best response is to communicate that Finance is ultimately taking responsibility for any variances caused by vacancy, and that no department will be "penalized," because Finance will be applying a company-wide vacancy rate. Although vacancy will drive some departments over budgets, others will offset that variance with great vacancy. In the end, the company should be aligned with this overall budget and leverage all of the additional investment or savings due to budgeting with vacancy.

With that said, some departments—like call centers, retail branches, and warehouses—may have a greater likelihood of vacancy than corporate departments like accounting, marketing, and leadership executives. The FP&A team should use its discretion and work with the departmental managers to determine the best vacancy rates for the company.

For additional FP&A insights, explore:

- A recap of a podcast episode on building resilient FP&A teams

- Considerations for selecting the right financial system for your organization

- Highlights from a conversation on elevating the role of finance

- A new FP&A Tomorrow podcast episode will air on Aug. 14, 2025, in which experts discuss budgeting best (and worst) practices

Plus, examine three critical ways Riveron is helping the office of the CFO navigate disruption and move from chaos to clarity.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.