- within Corporate/Commercial Law, Employment and HR and Technology topic(s)

- in United States

- with readers working within the Banking & Credit and Oil & Gas industries

SMART SUMMARY

- The "Liberation Day" announcement on April 2nd brought a halt to the lively opportunistic transactions that held ground throughout 2024 and beginning of 2025. May and June of this year, however, showed welcome signs of recovery from the lulls that characterized the start of the second quarter.

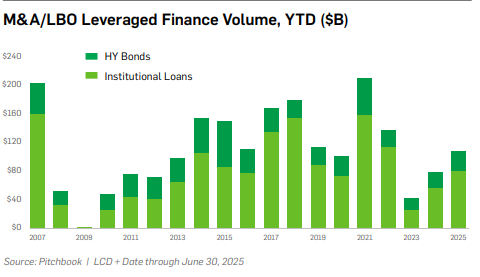

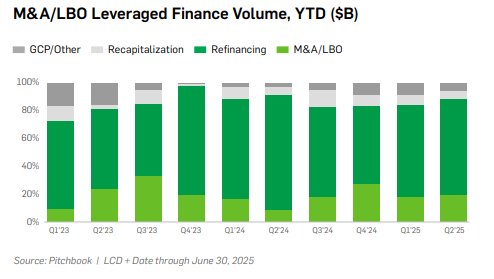

- Due to the heightened volatility and uncertainty that has continued to cloud the market, new issuance related to M&A activity experienced considerable declines in Q2'2025. Although M&A-driven issuance surpasses the equivalent period in 2024, such activity remains well below historical norms.

- The high-yield bond market set new records in Q2'2025; however, even with the records set this quarter, issuances still remain below historic levels.

Q1 2025 Recap

What began as a promising start to the year for activity in the leveraged loan and high-yield bond markets quickly turned turbulent due to increasing political and macroeconomic uncertainty. The first quarter was marked by heightened volatility driven mostly by tariff threats along with fears of recession and stagflation.1 January saw strong momentum, with narrowing spreads fueling robust repricing and dividend recapitalization activity and borrower-friendly covenant packages in the leveraged loan market. But that early optimism faded throughout the first few months of 2025.2 Hopes for increased M&A activity, lower interest rates, and sustained economic growth were gradually overshadowed by persistent inflation pressures and broader market instability which, together, weighed heavily on the leveraged finance market by the end of the quarter.3

The sense of uncertainty that clouded the market in the early months of 2025 continued into the second quarter, as market participants continued to grapple with how best to navigate the ongoing volatility.

Q2 2025 Volatility

Q2'2025 began with President Trump's "Liberation Day" announcement on April 2nd, unveiling steep tariffs on imports from several countries. The announcement rattled investors, raising concerns about economic growth and corporate stability. The new tariffs introduced fresh uncertainty for dealmakers, who anticipated a chilling effect on exits and were pricing in elevated risks of inflation and recession.4 The announcement of tariffs caused the new-issue loan and bond markets to virtually grind to a halt.5 Momentum began to build gradually over the course of the second quarter, and by the end of the three-month period, market conditions for loans and bonds had almost completely rebounded, facilitating a vibrant level of activity.

Leveraged Finance Markets Awaken Following Months-Long Slumber

At the beginning of Q2'2025, the primary loan and high-yield bond markets felt the toll as investors, spooked by the potential economic fallout from the new tariffs, pulled back sharply. Appetite for loans collapsed, triggering a 15-day freeze in the issuance of new broadly syndicated loans – the longest drought in years outside of typical seasonal slowdowns or crisis periods like the COVID-19 pandemic.6

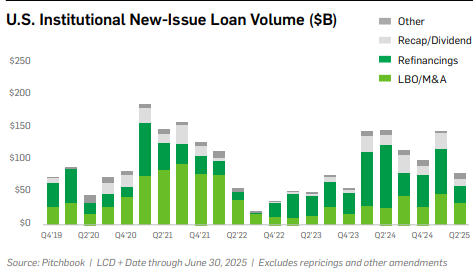

Modest signs of recovery – fueled largely by increased investor appetite following pauses in U.S. tariff implementation and easing geopolitical tensions – emerged in the first weeks of May as the broadly syndicated loan market began to rebound and launched 14 financings in the second week alone.7 Market participants in the leveraged loan market focused on businesses that were U.S. based, had limited supply chain exposure or operated in service-oriented sectors, which would be insulated from the ripple effects of tariffs.8 By late May, the U.S. leveraged loan market experienced its busiest days since early March as renewed confidence prompted borrowers to re-enter the market after lenders had pulled back in the wake of the tariff announcements on April 2nd.9 Despite the accelerated momentum that continued into June, loan volume for Q2'2025 was only $113 billion, the lowest amount since Q4'2023 and down from $354 billion compared to the same period last year.

Repricings also rebounded with considerable momentum throughout June.11 While the first post-"Liberation Day" repricing did not emerge until the final days of April, June alone saw 29 speculative-grade issuers amend their credit agreements to reduce the spreads on $28 billion in term loans. 12 The uptick, however, was not enough to overcome the hard hit opportunistic transactions had taken earlier in the quarter, with Q2'2025 repricings totaling at $28.5 billion, the lowest since Q3'2024 and down 85% from the first quarter of this year.13

Year-to-date leveraged loan issuance to support dividend recapitalizations reached $33.2 billion by the end of June, just slightly below the $35.4 billion recorded during the same period in 2024, the highest on record.14 The resilience in issuance suggested that, even in turbulent times, firms increasingly pursue opportunistic strategies to generate portfolio returns.15 As a comparison, only three dividend recap loans were launched during the entire month of March. Similarly, sponsor-backed companies have issued $6.5 billion of high-yield bonds in the first half of 2025 to support dividend recapitalizations (a high since 2011) with overall volume for dividend recapitalization bonds reaching $8.2 billion (more than the 2022-2024 totals combined).16

Post-"Liberation Day" Freeze Reignites Direct Lending

Direct lenders took advantage of the market dislocation in the early part of the second quarter to reverse recent pricing trends. Though early April surveys of market participants predicted widening spreads beyond 500 bps over SOFR, so far this year, 37% of direct lending transactions in the United States and Europe had spreads under 500 bps and only 18% had spreads of 600 bps or higher.17 And, despite increased direct lending volume supporting buyout activity, the $121 billion of direct lending issuance in the first half of 2025 lags behind the $143 billion in the same period of last year.18

M&A Activity Faces Prolonged Halt, With Considerable Declines in Second Quarter

Despite the aforementioned renewal in investor confidence, M&A-related dealmaking has remained on hold – a far cry from the boom anticipated to result from the new administration.19 New loan issuance financing M&A activity totaled $80.9 billion in the first half of 2025, an increase of 44% compared to the same period last year.20 Although M&A activity has shown marketable improvement yearover-year, the comparisons are against a subdued base in 2024 and depict activity that is well beneath historical norms.21 Conversely, high-yield bond issuances for M&A and LBO funds hit a four year high at $26.6 billion in the first half of 2025 with issuances for LBO funds making up 5% of the highyield bonds issued thus far in 2025 (up from 3% in 2024 and 2.9% in the 2020 pandemic-era).22

Record Setting Resurgence in the High-Yield Bond Market

The high-yield bond market ended Q2'25 with a four-year volume high at $76.2 billion (up from $68.6 billion in Q1'25), with $36.6 billion issued in June alone – the busiest June since 2021.23 Further, global high-yield bond issuances had the busiest quarter since Q3'21 with issuances soaring to $121.8 billion in Q2'25 up from $88.8 billion in Q1'2524 – ending with the first triple C-rated deal in nearly a year, courtesy of sponsor-backed Flora Food Group BV.25 As we predicted last quarter, the bond market saw an increase in "reverse Yankee" deals – where U.S. issuers raise money in the euro-dominated bond markets – with $45.1 billion issued in Q2'25 (up from $37.2 billion in Q1'25 and $39.2 billion in Q2'24), bringing the total for the first half of 2025 to $82.1 billion (up from $68.2 billion in the first half of 2024).26.

More and more opportunistic bond issuances are reverse Yankee issuances, which have recently provided U.S. companies with lower borrowing costs and a chance to diversify its sources of funding.27 Instead of waiting for maturities to come closer, issuers are choosing to opportunistically access markets and issue bonds to get ahead of their funding budget for the year.28 For example, financial companies – some of the biggest sellers of corporate debt often accounting for more than 40% of annual volume of corporate debt – had already sold about 70% of their expected funding needs for 2025 at mid-June (compared to 45% in 2024).29

Despite the momentum at the end of Q2'25, high-yield bond volume in the first half of 2025 is down 11% from the first half of 2024 with issuers rated triple-C or lower representing only 2% of 2025 volume (half of the rate in 2024 and in line with the historic low in 2023) – while approximately 41% of all bonds issued in the first half of 2025 have been double-B rated.30

Q3 2025 Outlook

If the global trade landscape becomes clearer, volatility may ease, making way for a more reliable new issue market and normalized pricing behavior. Tariffs themselves may not be the core issue as borrowers and lenders can adapt and price accordingly, but uncertainty must recede for investor confidence to return, even if spreads stay elevated. Bond issuances are expected to continue into July, so long as demand remains high and uncertainty in the markets remains relatively low; however, the bond market will likely slow down as we move further into 2025, as is typical but intensified as issuers have chosen to front-load their annual financing needs by opportunistically refinancing in the first half of 2025.31 We anticipate that most issuers will be hesitant to commit to large M&A transactions until corporate taxes and tariffs are solidified; however, even if M&A transactions pick up later in 2025, those transactions will likely be financed in 2026 (rather than the remainder of 2025).32 Conversely, we anticipate that the increased supply of reverse Yankee issuances will continue throughout 2025, especially as market conditions continue to offer cost savings for U.S. issuers. The momentum established at the end of the second quarter has created a favorable deal-making environment from a debt financing perspective, and private credit activity is expected to stay robust, offering flexibility and speed in exchange for slightly higher pricing.

Footnotes

1 Maria Dikeos, Market Uncertainty Limits New US Loan Activity in 1Q25, Gold Sheets (April 1, 2025).

2 Elizabeth Yazgi, Loan Market Covenant Trends – 1Q25, LSTA (April 28, 2025).

3 Elizabeth Yazgi, Loan Market Covenant Trends – 1Q25, LSTA (April 28, 2025).

4 James Thorne, Dealmakers Grapple with Fresh Uncertainty Following Trump's 'Liberation Day' Tariffs, Pitchbook (April 3, 2025).

5 James Thorne, Dealmakers Grapple with Fresh Uncertainty Following Trump's 'Liberation Day' Tariffs, Pitchbook (April 3, 2025).

6 Maria Lukatsky, April Wrap: Loan Market Rattled by Volatility Spoke, Issuance Freeze, Pitchbook (May 1, 2025).

7 Madeline Fixler, Lev Loans Return as Tariff Fears Recede, Gold Sheets.

8 Madeline Shi, Why Some PE Megadeals Have Defied the Tariff-Driven Halt, Pitchbook (April 25, 2025).

9 Madeline Fixler, Lev Loan Market Shifts into Gear, Gold Sheets.

10 Maria Lukatsky, Q2 Wrap: Leveraged Loan Dealmaking, Prices Pick Up After April Outage, Pitchbook (June 27, 2025).

11 Maria Lukatsky, Q2 Wrap: Leveraged Loan Dealmaking, Prices Pick Up After April Outage, Pitchbook (June 27, 2025).

12 Maria Lukatsky, Q2 Wrap: Leveraged Loan Dealmaking, Prices Pick Up After April Outage, Pitchbook (June 27, 2025).

13 Maria Lukatsky, Q2 Wrap: Leveraged Loan Dealmaking, Prices Pick Up After April Outage, Pitchbook (June 27, 2025).

14 Maria Lukatsky, Q2 Wrap: Leveraged Loan Dealmaking, Prices Pick Up After April Outage, Pitchbook (June 27, 2025).

15 Abhinav Ramnarayan, Eleanor Duncan and Rachel Graf, Under-Pressure Buyout Firms Ramp Up Debt Deals for Dividends, Bloomberg (May 13, 2025).

16 US Credit Markets Quarterly Wrap: High-yield borrowers ride rapid recovery in eye of tariff storm (PITCHBOOK, July 1, 2025).

17 Abby Latour, Q2 US Private Credit Wrap: Mega Loans Salvage Deal Flow Wrecked by Tariffs, Pitchbook (June 30, 2025).

18 Abby Latour, Q2 US Private Credit Wrap: Mega Loans Salvage Deal Flow Wrecked by Tariffs, Pitchbook (June 30, 2025).

19 Michelle F Davis, Aaron Kirchfeld, Bailey Lipschultz and Yigin Shen, Bankers Were Dreaming of M&A Riches Under Trump. It Hasn't Worked Out, Yet (March 26, 2025).

20 Maria Lukatsky, June Wrap: US Loan Market Rises 0.8%, Hits Record $1.5T as Risk Appetite Grows, Pitchbook (July 1, 2025).

21 Maria Lukatsky, Q2 Wrap: Leveraged Loan Dealmaking, Prices Pick Up After April Outage, Pitchbook (June 27, 2025).

22 US Credit Markets Quarterly Wrap: High-yield borrowers ride rapid recovery in eye of tariff storm (PITCHBOOK, July 1, 2025).

23 Interactive High-Yield Report, available at https://pitchbook.com/news/reports/ july-2-2025-us-high-yield-bond-weeklywrap (PITCHBOOK, July 1, 2025); US Credit Markets Quarterly Wrap: High-yield borrowers ride rapid recovery in eye of tariff storm (PITCHBOOK, July 1, 2025).

24 US Credit Markets Quarterly Wrap: Bond issuance booms on both sides of the Atlantic (PITCHBOOK, July 1, 2025).

25 Europe's Junk Bonds Cap Record Month With €22.5 Billion of Sales (BLOOMBERG, July 1, 2025); European junk bond sales hit record as investors cut US exposure (FINANCIAL TIMES, June 30, 2025).

26 Timothy Rahill and Marine Leleux, US Dollar Credit Supply (ING GROUP, July 1, 2025); 'Reverse Yankee' deals hit record as US companies flock to euro debt market (FINANCIAL TIMES, May 15, 2025).

27 'Reverse Yankee' deals hit record as US companies flock to euro debt market (FINANCIAL TIMES, May 15, 2025).

28 Junk bond sales surge as companies try to beat fresh tariff uncertainty (FINANCIAL TIMES, June 8, 2025); 'Reverse Yankee' deals hit record as US companies flock to euro debt market (FINANCIAL TIMES, May 15, 2025).

29 US Corporate Bond Sales Expected to Drop After Banks Slow Issuance (BLOOMBERG, July 3, 2025).

30 US Credit Markets Quarterly Wrap: High-yield borrowers ride rapid recovery in eye of tariff storm (PITCHBOOK, July 1, 2025).

31 US Corporate Bond Sales Expected to Drop After Banks Slow Issuance (BLOOMBERG, July 3, 2025); Junk bond sales surge as companies try to beat fresh tariff uncertainty (FINANCIAL TIMES, June 8, 2025). 32 US Corporate Bond Sales Expected to Drop After Banks Slow Issuance (BLOOMBERG, July 3, 2025).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.