- within Law Department Performance, Environment and Energy and Natural Resources topic(s)

- with readers working within the Technology industries

A version of these insights first appeared in Forbes Finance Council.

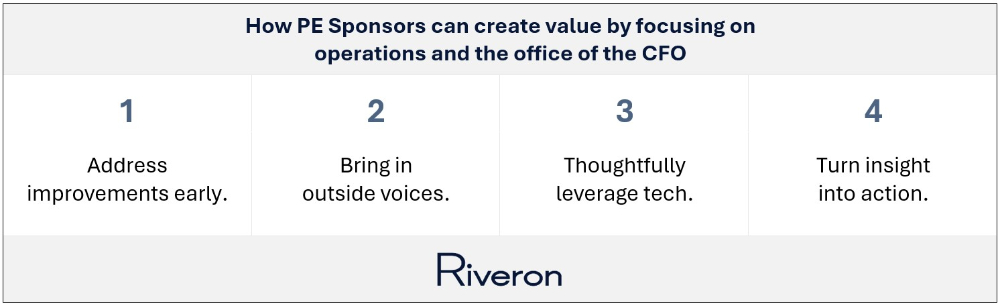

Private equity leaders are increasingly recognizing a need to maximize growth in portfolio company operations. The past half decade of unique macroeconomic circumstances—from COVID to interest rate policies—has limited access to traditional financial engineering methods to drive returns. The current climate is pushing many private equity firms to revisit their strategies and focus on fostering operational excellence from the inside out.

"While many PE firms have historically built value by acquiring and integrating companies, that deal-focused strategy is proving less effective today. Now, many sponsors are finding they must pivot their focus to driving operational improvements... and empowering the office of the CFO."

While many private equity firms have historically built value by acquiring and integrating companies, that deal-focused strategy is proving less effective today. Now, many sponsors are finding they must pivot their focus to driving operational improvements within their portfolio companies, particularly by strengthening and empowering the office of the CFO, an area often overlooked in past approaches. In today's environment, private equity-backed organizations can thrive by moving beyond surface-level optimization and taking a deliberate, hands-on approach to improving portfolio company operations. This includes everything from commercial effectiveness and supply chain optimization to making lasting improvements within the office of the CFO.

Drawing on my experience advising private equity clients, I've seen firsthand how transforming the finance function can unlock meaningful performance gains across a business. By modernizing systems, improving data visibility, and empowering finance leaders to shift from recordkeeping to strategic guidance, sponsors can accelerate value creation in measurable ways. In a market where every dollar counts, the office of the CFO has reemerged as a critical lever for driving long-term growth and differentiation.

Address improvements early

Long before private equity professionals make an offer on a potential investment, they conduct extensive research, verify investment potential, and identify preliminary risks. However, the rigor of the deal process and road to close often leaves management teams fatigued and reluctant to make significant changes out of the gate. Failed sales processes across the private equity landscape are a glaring indication of the industry's need to adapt. Despite the potential lift surrounding people, process, and technological change, leaning into early action maximizes returns on the back end and reduces the cost of these efforts in the long run.

Some of the most persistent operational gaps in PE-owned companies present themselves within the office of the CFO, placing accounting, finance, and technology functions at risk. Many portfolio companies cycle through CFOs or other financial leaders during a hold period, especially in first equity sponsor scenarios. Even if progress is made under one leader, it is often lost in the chaos of persistent organizational upheaval. These challenges are especially pronounced in smaller businesses, where early-stage success often deprioritizes establishing scalable, foundational infrastructure. It is easy to prioritize growth at the expense of infrastructure reinvestment in a portfolio company's early days, but acknowledging and purposefully investing in strong financial leadership during the hold period provides runway to accelerate growth and, more importantly, maximize exit value.

Bring in outside voices

Private equity firms often expect CFOs to fill multiple roles. These "jack-of-all-trades" expectations include simultaneously being a chief accounting officer, vice president of FP&A, chief information officer, chief technology officer, chief corporate development officer, and more. Admitting that one size does not fit all and leaning into external expertise paves the way for better tech advancement. Seeking counsel also helps avoid bias toward a potentially ineffective long-term solution.

Third-party advisors cut through internal bias by evaluating situations objectively, using clear business requirements, current-state infrastructure, and the deal thesis as their guide. They can also support accurate budget setting early, preventing mismanaged expectations that lead to massive cost overruns and impact job security. Most importantly, an outside advisor limits the risk of selecting the wrong solution or including unnecessary add-ons and ensures alignment with stakeholder interests. Nearly half of private equity technology engagements within the office of the CFO I've seen in the past five years have been to fix a suboptimal selection or implementation process, compared to supporting a client with getting it right the first time.

Thoughtfully leverage tech

Performance visibility plays an increasingly important role in value creation exercises. Much like a doctor requires accurate, state-of-the-art equipment to evaluate a patient's physical well-being, CFOs and controllers need real-time, reliable data to monitor working capital, forecast cash flow and ensure compliance. While people and processes remain critical, effective technology enhancement is the quickest path to unlocking value.

Too often, companies rush into technological upgrades, resulting in underestimated costs and tools that don't align with the company's structure or reporting needs. By engaging either operating partners or vetted third-party advisors early in the process, sponsors and management teams can avoid missteps and reduce distractions for finance leaders. Ultimately, modern finance technology empowers private equity-owned companies to operate more efficiently and strategically day to day. For example, our team helped one private-equity backed organization implement an ERP that was right-sized for the company's operations. Through this proactive effort, the company streamlined its procure-to-pay and accounts payable processes, which eliminated its onerous legacy system and enabled leadership to access timely, accurate data. This is just one of many examples that show how investing in automation, planning, and reporting tools allows finance leaders to shift their team's focus from lower-value work to supporting value creation.

Turn insight into action

In today's market of high interest rates and prolonged exit timelines, execution is everything. I've long heard the saying, "A consultant is someone who borrows your watch to tell you the time—and then keeps your watch." It's a telling cliché, especially as clients seek hands-on partners.

The private equity firms and portfolio companies that outperform others will build a culture of operational rigor, address needs early, leverage helpful voices, and lead change effectively. This is especially true in the office of the CFO, where timely access to data, accurate forecasting, and strong internal controls directly influence a company's ability to grow and scale. Finance leaders who pair insight with action can become powerful value creators. And the private equity sponsors who enable that transformation will gain a durable edge in an increasingly competitive market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.