- within Finance and Banking, Environment and Technology topic(s)

- in United States

SMART SUMMARY

- In 2024, companies were reluctant to commit themselves to funding additional investments, including real estate investments. As a result, in 2025, there is increased liquidity in the market on the buy side and the debt side, with private equity firms eager to find opportunities.

- Many publicly traded REITs continue to experience a disconnect between their net asset value and their share price, leading to pressure from shareholders to explore strategic alternatives.

- Momentum is growing in the REIT privatization space. Notably, Blackstone acquired AIR Communities, purchasing the shares of the public REIT at a 25% premium. Public REITs, such as Elme Communities and Paramount Group, have recently announced that they would be exploring "strategic alternatives" to their current business model.

The real estate investor trust ("REIT") sector in 2025 presents a dynamic landscape, characterized by evolving market conditions and strategic opportunities. Notably, the trend of taking REITs private has gained momentum, offering potential advantages for investors.

Towards the end of 2024, there was a significant level of uncertainty in the market stemming from geopolitics, the election, and interest rates. Cost of capital matters to every business in the world, but it is particularly important to the real estate sector, where the product is an inherently steady performer, but a capital-intensive business.

REIT M&A activity was at its lowest point in ten years in 2024, as many companies have been taking "the wait and see" approach due to the volatility in the market. This trend has led to company's having excessive liquidity on both the cash and the debt side, making REIT privatizations a ripe opportunity to play a significant role in the private equity and M&A landscape in the near to mid-term.

There are several key factors contributing to the current environment favoring REIT take-private transactions. Most notably, many publicly traded REITs are experiencing a disconnect between their market prices and their net asset value ("NAV"), and their shares often being traded well below NAV. For public REIT shareholders, persistent underperformance relative to NAV can be frustrating, however, where there is disconnect between share price and NAV, there is opportunity for both a purchaser and seller. The undervaluation presents acquisition opportunities for private investors who have liquidity and are seeking assets at discounted prices while providing the shareholders of public REITs the opportunity to sell their shares at a premium.

As with all REITs, private REITs do not pay federal income tax at the corporate level and instead let income and deductions pass through to the individual investors, leading to a decreased tax liability. Taking a REIT private has the additional benefit of increased operational flexibility while eliminating public market compliance costs, saving millions in internal compliance department costs, audit fees and more. There is also the added benefit to management and ownership not to have to address the scrutiny and time-consuming process of quarterly public market analyst reviews. In the middle of 2024, Blackstone called the bottom of certain sectors of the real estate market and placed a sizeable bet on Apartment Income REIT, known as AIR Communities. Blackstone purchased all of the outstanding shares from AIR Communities for a total of $10 billion and has stated that it plans to invest another $400 million to maintain and improve the portfolio, fueling future growth. Moreover, the shareholders of AIR Communities were able to sell their shares at a 25% premium compared to its closing price on the NYSE on April 5, 2024.

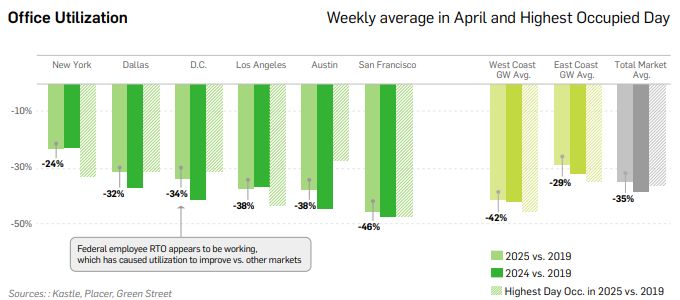

According to Blackstone president Jon Gray, "[the] [o]ffice [sector] has bottomed, particularly in stronger markets and better-quality buildings." This sentiment appears to be holding true, as utilization rates continue to improve, particularly in the east coast gateway cities and the Sun Belt as businesses continue its push for return to office. Blackstone has continued to bet on NYC Class A office as it recently purchased a 49% interest in 1345 Avenue of Americas.

Adding to the potential REIT take private momentum, in February 2025, Dream Residential Real Estate and Elme Communities announced that they too would be seeking strategic alternatives. More recently, in May 2025, Paramount Group ("PGRE"), a multi-billion-dollar office REIT, announced that it is considering strategic alternatives to maximize shareholder value. Following its announcement that it was evaluating a change to its current business model, shares of PGRE jumped over 13%, outperforming its peers by 1,280 bps. This trend indicates that there will be an uptick in the REIT private equity and M&A sector, as other REITs will likely face pressure to evaluate maximizing shareholder value by considering "going private."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.