- within Insolvency/Bankruptcy/Re-Structuring, Criminal Law and Law Practice Management topic(s)

US pharmaceutical companies have long been a dominant force in global foreign direct investment (FDI), contributing around 25% of outbound FDI in the sector and over half of global pharmaceutical research and development (R&D) spending.1

This leadership is rooted in the strong profitability of the US market. Historically, revenues from higher drug prices have funded significant investment from US firms in R&D and manufacturing overseas. These investments have allowed them to leverage global talent, access diverse patient populations and benefit from tax policies and pricing structures in other geographies.

However, this trajectory is entering a period of uncertainty. Tariffs, pricing reforms and changes to reimbursement policies are threatening to erode US market profitability, with potentially far-reaching effects on global R&D strategies and FDI flows.

This article, part of our "Navigating Global Pharma Policy" series, explores how policy pressures could reshape global pharma innovation, highlighting the rise of new life science hubs in emerging economies, and the emphasis on technology and digital capabilities to increase R&D productivity.

R&D investments have increasingly focused on precision medicines and advanced therapeutics.

US R&D leadership and priorities

The US healthcare system is primarily private insurance-funded, a model that has enabled US companies to generate substantial profits from sales of both innovator, generic, and biosimilar treatments.

According to the nonprofit Commonwealth Fund, prescription drug prices in the US are often two to three times higher on average than those in other developed countries.2

This profitability has underpinned high levels of R&D investment, both domestically and internationally, through outbound FDI. In 2024, the US pharmaceutical industry spent approximately $100 billion on R&D, accounting for more than 50% of global R&D investment3 (other major contributors are Germany, UK, Switzerland, Japan, and China.) The country is responsible for over 80% of drug launches and invests nearly four times in R&D, as a share of GDP, than its peers, playing an outsized role in driving drug discovery and advancing medical innovation.4

In recent years, the industry has evolved within both small and large molecule modalities to develop more complex and specialised drugs, including biomarker-driven precision therapies and advanced therapeutics such as gene and cell therapies. This reflects a growing focus on developing curative, preventive or disease-modifying treatments in fields such as oncology and rare diseases, complementing the industry's continued investment in chronic disease management.

The large investments to develop next-generation therapies have reverberated across the entire pharma ecosystem, with all segments in the value chain seeking the adoption of advanced technologies, from clinical trials to manufacturing, supply chain, and beyond.

Analysts expect policy-driven tariffs and pricing reforms to have an inflationary effect on the US healthcare system.

US profitability at risk as pressures build

Upcoming tariffs and policy changes in the US are expected to affect the ability of both global and US-headquartered companies to invest in R&D. The new US administration is attempting to radically reshape the country's healthcare landscape, focusing on measures to bring down prices to consumers and improve drug supply security. Key developments include:

1 Pricing reforms

In May 2025, the US government enacted an Executive Order (EO) aimed at cutting US prescription drug prices by up to 80% through a Most Favoured Nation (MFN) pricing model, which aligns drug prices with the lowest charges in other developed nations. Since then, MFN pressure has intensified with the administration setting firm deadlines for the industry to comply. In response, some pharma companies are rethinking their commercial models, including by improving direct-to-consumer (DTC) access and exploring value-based pricing (read more here).

For many large, research-driven pharma companies, which typically generate more than half of their global revenue from the US market, this level of profitability pressure could significantly constrain their ability to invest in next-generation therapies and digital innovation.

2 Tariff threats

While US President Donald Trump has previously threatened levies of up to 250% on pharmaceutical companies, the US-European Union (EU) trade deal in July established a base tariff rate of 15% on EU branded pharmaceuticals. Still, analysts expect higher tariff costs to have an inflationary effect on the US healthcare system, both directly as consumers pay more for imported medicines and indirectly through higher insurance premiums.

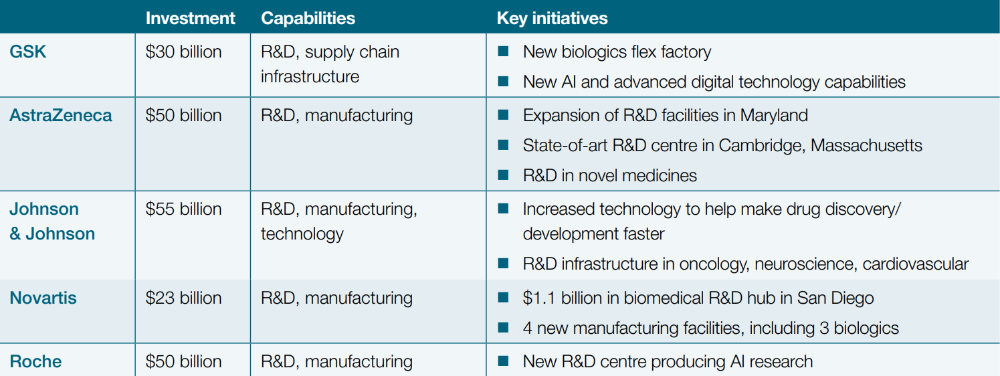

To mitigate the threat of tariffs, several multinational pharma groups have pledged to increase their manufacturing and R&D footprint in the US, with over $350 billion in funding announced in recent months:5 (read more here).

3 DTC advertising

The new Trump administration is discussing policies to make it harder and more expensive for pharmaceutical companies to advertise directly to patients, a move that could disrupt more than $10 billion in annual advertising spending, potentially hitting sales. AbbVie alone spent $2 billion on DTC drug ads last year, primarily on advertising for the company's anti-inflammatory drugs Skyrizi and Rinvoq, which brought over $5 billion in revenues for the firm in the first quarter of 2025.6

While reduced marketing spend could free up budgets for reinvestment into R&D, the financial impact is unlikely to materially offset the revenue shortfalls driven by ongoing price erosion.

How R&D strategies could change

As R&D budgets contract, global pharmaceutical companies will be forced to make strategic moves to ensure pipeline sustainability and remain competitive. Some of the potential actions we have identified include:

1 Focus on productivity levers

With tighter budgets and rising pressure to deliver return on their R&D investments, pharma companies must double down on R&D productivity levers. These include tools and strategies that boost speed, success rates, safety, and cost-efficiency in drug development. Expect accelerated investments in AI and cutting-edge computational technologies, which are already gaining momentum in R&D. Examples include:

- Phesi's digital placebos,7 which leverage AI-powered digital twin solutions to replace the stand-of-care control arm of a clinical trial.

- BMS' use of AI and machine learning to advance protein degradation science, accelerating the delivery of new medicines with a clear path to clinical proof of concept.8

- Technologies like CRISPR and other gene-editing tools to accelerate the development of highly targeted therapies that command premium pricing, such as oncology and rare diseases.

2 Organisational restructuring

Reduced R&D funding may prompt the implementation of broader organisational restructuring. This could include measures such as delayering, which can foster agility and lower overhead costs, and the reallocation of R&D activities to regions with lower operational costs such as India and Eastern Europe. Novartis and AstraZeneca, for instance, have expanded their R&D and manufacturing footprints in India to leverage cost advantages in labour, infrastructure, and regulation.9

3 Change in modality focus

In an environment of squeezed profitability, companies may rebalance investment portfolios, prioritizing mid- to latestage programs with clearer commercialisation paths while leveraging partnerships and venture investments to sustain early-stage innovation. In contrast, more established modalities with lower scientific and technical risks, and well-defined paths to profitability, can be prioritised. This shift could also ripple through the broader life science ecosystem, leading to a reduction in investor confidence and less funding into early-stage biopharmaceutical and biotechnology ventures.

Pharma giants may look for lowercost locations, deepening ties with emerging innovation hubs, local talent, and regulatory advantages.

4 Greater R&D mobility

To curtail the higher cost of development in the US and other established centres, pharma giants may look for lower-cost locations, deepening ties with emerging innovation hubs to access new funding sources, local talent, and regulatory advantages. Asia-Pacific and the Middle East region are likely to play a larger role in the ecosystem, both as destinations for redirected R&D funds, or as capital providers through sovereign wealth funds (read box opposite). 10 In contrast, traditional innovation hubs like the UK's "Golden Triangle" and Spain, a key region for clinical trials, might see reduced inflows.

As R&D flows shift, regional corridors that gained traction in pharma FDI in recent years are set to grow further. India stands out as a key destination for R&D and manufacturing, bolstered by policy reforms allowing 100% FDI in greenfield pharma projects, and strong cost benefits.

China, despite geopolitical tensions, will likely continue to stay relevant for its scale and access to talent and technology. As recently as March this year, AstraZeneca committed to a $2.5 billion investment on a R&D hub in the country, which the company said will collaborate with "the cutting-edge biology and AI science" in Beijing, and be a critical part of efforts to bring innovate medicines to patients worldwide.11

Middle East's biopharma hub could be winner in global pharma reshuffle

Governments across the Middle East are actively diversifying their economies beyond oil and gas by prioritising investments in critical sectors such as life sciences and healthcare. To attract foreign businesses and capital, these countries are offering financial incentives, building infrastructure, and strengthening regulatory alignment, including improved IP protection for pharmaceutical and biotechnology products.

Multinationals including Pfizer, Novartis, GlaxoSmithKline and AstraZeneca have already partnered with local governments in the region, with investments spanning vaccine development to manufacturing and cell and gene therapies capabilities.

Saudi Arabia is one of the leaders in this transformation. The country has streamlined clinical trial approvals and created specialised hubs like Riyadh's BioCity, which offers biotech-ready infrastructure with access to talent, research centres, and logistics networks. The initiative is funded by the Saudi Arabia's Public Investment Fund (PIF) and aims to contribute $34.6 billion to the national economy by 2040.

Additionally, state-backed investors in the region are playing an increasingly active role in the sector. Sovereign wealth funds such as PFI and Abu Dhabi's ADQ and Mubadala have become key financiers of capital-intensive life sciences R&D as well as infrastructure projects. For instance, Qatar Investment Authority participated in funding rounds for US genomic medicine company Ensoma in 2023 and, more recently, for radiopharmaceutical biotech company Isotope Technologies.12 These funds may be well positioned to bridge potential funding gaps as global pharma groups seek to maintain traditional levels of R&D spend 10 National Biotechnology Strategy against a backdrop of reduced profitability.

Strategic steps for R&D success

The pharmaceutical and biotechnology sector operates as a truly global business, researching, developing and supplying lifesaving and healthenhancing treatments to patients worldwide. However, disruptive forces are shaking some of these foundations, with profound implications for how companies innovate, invest, and operate.

While the innovation heartlands of North America and Western Europe will remain central to pharmaceutical activity and continue to attract investment dollars (both private, public and charitable), there is a clear trend toward greater mobility in funding for R&D, manufacturing, and technology. To navigate this, companies should prioritise the following actions:

1. Strengthen regional engagement: build closer ties with research hubs, academic institutes and key opinion leaders in specific therapeutic areas. Deepen connections with emerging innovation hubs to tap into regional expertise and access new talent pools.

2. Enhance operational agility: Build in flexible operational and organisational capabilities that can quickly adapt to changing funding sources and market conditions. Align R&D and manufacturing strategies with regional opportunities and diversify investment portfolios to mitigate geopolitical risks.

3. Deepen policy engagement: Maintain and even increase engagement with government bodies, trade associations and policymakers globally. Clearly articulate the economic and societal value of pharmaceutical and biotechnology investments, including contributions to job creation, healthcare advancements and broader wellness agenda at a regional and country level.

4. Communicate the "halo" effect of R&D: Highlight the broader economic impact of pharmaceutical investments, particularly in clinical trials and advanced pharmaceuticals, to help inform policy makers.

Pharma leaders must remain vigilant and incorporate flexibility into their strategies to navigate the volatile trading environment.

Key takeaways

- Pricing reforms and tariffs are threatening the profitability of the US pharma market, a long-standing engine of global R&D, potentially reshaping how large pharma companies allocate and strategise R&D investments worldwide.

- To ensure pipeline sustainability and competitiveness, companies must consider moves including a renewed focus on R&D productivity levers and de-risking innovation by shifting investment to more cost-effective geographies and lower-risk drug modalities.

- While adjusting R&D priorities in the short to medium term, pharma companies should maintain momentum on long-term strategic goals and embed the flexibility needed to navigate an increasingly volatile trading environment.

This is just one piece of the puzzle. There are several other looming policy changes that pharma companies must prepare for. Follow our "Navigating Global Pharma Policy" series for more insights on policy implications and strategic actions for pharma and biotech.

Footnotes

1 The role of FDI in the pharmaceuticals industry

2 Big Pharma flinches on Trump tariffsL Eli Lilly, GSK promise investment

3 The Pharmaceutical Research and Manufacturers of America (PhRMA), CapIQ data, A&M analysis.

6 RFK Jr.'s Drug-Ad Crackdown Plan Threatens a $10 Billion Market - Bloomberg

8 AI-driven protein degradation research reshaping drug discovery - Bristol Myers Squibb

10 National Biotechnology Strategy

11 AstraZeneca investing $2.5 billion in China as drugmaker seeks to recover from scandals | Reuters

12 Qatar Investment Authority: a driving force in biotech advancements

Originally published 4 November 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.