- within Real Estate and Construction topic(s)

- in Africa

- in Africa

- within Real Estate and Construction and Tax topic(s)

The Gulf Coast is experiencing a surge in renewable energy projects, industrial projects and data center projects throughout our region. When targeting potential project sites, developers and investors should identify early on whether Committee on Foreign Investment in the United States (CFIUS) approval will be needed for the project. This early stage due diligence is especially important in the Gulf Coast due to the high number of military bases and ports within close proximity to potential project sites.

For much of its history, CFIUS operated behind the scenes. Created in 1975, CFIUS assists the President of the United States by reviewing the national security implications of foreign direct investment in the country. Recently, CFIUS has played an expanding role in real estate transactions across the Phelps footprint. Investment decisions by foreign investors increasingly involve a regulatory risk analysis in a transaction's early stages, a trend that highlights the importance of proactively engaging real estate counsel with CFIUS experience.

In this client alert, we outline CFIUS' jurisdiction over certain real estate transactions, the consequences of CFIUS' expanding authority for foreign investors in the Gulf South and potential regulatory developments during the second Trump Administration.

Covered Real Estate Transactions

In 2018, motivated by concerns about Chinese investment in U.S. companies with advanced technology, Congress significantly expanded CFIUS' authority by passing the Foreign Investment Risk Review Modernization Act ("FIRRMA"). Since FIRRMA's passage, CFIUS has exercised its authority to review real estate transactions and extended its related enforcement activities, a trend that has particular relevance for real estate transactions in the Gulf South due to the region's ports and military installations.

FIRRMA expanded the scope of transactions within CFIUS' jurisdiction by including for review real estate transactions in close proximity to a military installation or a U.S. government facility or property of national security sensitivities. In 2020, the U.S. Department of the Treasury ("Treasury") issued a final rule in 31 CFR Part 802 ("Part 802") outlining CFIUS' authority to review "covered real estate transactions," i.e., the (a) purchase, lease or concession (b) by a "foreign person" of (c) certain "covered real estate" in the United States. Each element of covered real estate transactions is described in more detail below:

(a) Purchase, Lease or Concession – To trigger Part 802, the real estate transaction must grant the foreign person at least three of the following real property rights: (i) physical access to the property, (ii) the right to exclude others from the property, (iii) the right to improve or develop the property and (iv) the right to affix structures or objects to the property. In practice, nearly every option, sale or lease to a foreign person meets these criteria.

(b) Foreign Person – A "foreign person" is any foreign national, foreign government or foreign entity, or any entity over which control is exercised or exercisable by a foreign national, foreign government or foreign entity. For businesses with complex organizational structures, Part 802 gives CFIUS latitude to assess control on a case-by-case basis and prioritize substance over form. Put another way, CFIUS has authority to "look through" complex ownership structures to determine actual control.

Notably, CFIUS regulations exempt certain real estate transactions involving investors from certain countries based on CFIUS' determination that those countries pose less risk to U.S. national security. Among other requirements, for an entity to qualify as an "excepted real estate investor," any foreign person that individually or as part of a group holds 10% or more of the entity's voting or economic interests must either be (a) a national of an excepted foreign state (and only an excepted foreign state) or (b) an entity organized under the laws of an excepted foreign state.

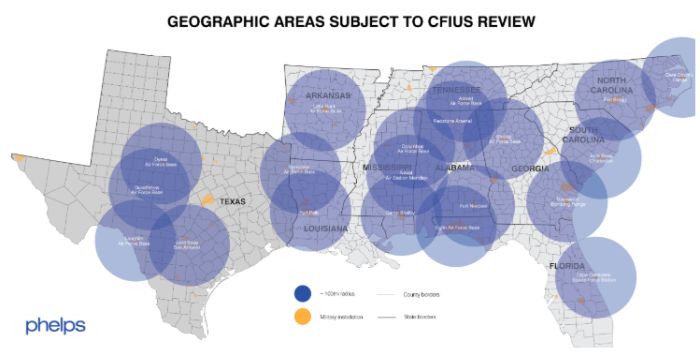

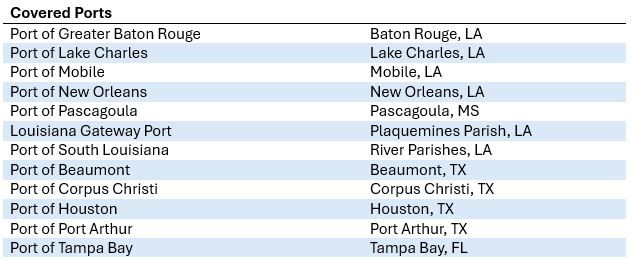

(c) Covered Real Estate – Covered real estate includes property within either one or 100 miles of certain military installations and property that is within or will function as part of specified ports, including large hub airports and top 25 tonnage, container, or dry bulk ports. Real estate within an U.S. Census Bureau "urbanized area" or "urban cluster" is excepted from "covered real estate" unless it is part of a covered port or within one mile of a military installation.

Geographic Expansion of Covered Real Estate under FIRRMA

In November 2024, Treasury finalized a rule to bring 40 military installations under CFIUS' one-mile jurisdiction and 19 installations under its 100-mile jurisdiction. CFIUS also transferred eight installations from one-mile jurisdiction to 100-mile jurisdiction. The number of listed installations now stands at 225 and includes the following installations in the Gulf South:

As shown in the map below, the 100-mile radius installations significantly increase the scope of real estate transactions subject to CFIUS review. Please note that (1) the graphic is intended to give an approximation of CFIUS' 100-mile jurisdiction and (2) the map does not illustrate urban clusters, or census tracts with more than 20,000 people, which are carved out of the regulatory definition of covered real estate.

For property that "is, is located within, or will function as part of" a port, the investor must determine if the port meets specified criteria and is therefore a "covered port." Covered ports include (a) large hub airports, (b) cargo airports greater than 1.24 billion pounds, (c) joint use airports, (d) strategic seaports and (e) the top 25 tonnage, container or dry bulk ports, the latter of which includes the following ports along the Gulf Coast:

Risk Analysis for Foreign Investors / Greenfield Investments

FIRRMA's expansion of CFIUS' jurisdiction over certain real estate transactions adds another layer to the risk analysis for foreign investors. After an initial determination that the property is covered real estate, the parties must then decide whether to file for CFIUS review. While covered real estate transactions do not create a mandatory filing requirement, the parties may opt to "clear" the transaction by submitting a voluntary filing. Importantly, CFIUS has the authority to initiate reviews of "non-notified transactions" months or even years after the transaction closes if the agency determines the transaction has national security implications.

Filers have the option to submit either a short-form "Declaration," which triggers a 30-day assessment period, or a more comprehensive "Notice," which has longer "review" and "investigation" periods that can last between 45 and 105 days. While a Declaration does not require a filing fee and offers the potential of CFIUS approval on an expedited timeframe, CFIUS may ask the parties to submit a full Notice after its initial review of the Declaration, effectively starting the process over.

Describing the filing as "voluntary" is potentially misleading, as the decision not to file comes with substantial risk. For example, in May 2024, President Biden issued an Executive Order requiring MineOne, a Chinese-owned cryptocurrency miner, to divest property it owned within one mile of a U.S. strategic missile base in Wyoming after CFIUS received a tip from a member of the public and initiated a "non-notified" review. The Executive Order imposed an aggressive divestment timeline, requiring MineOne to remove equipment and improvements from the property within 90 days and fully divest its ownership stake within 120 days.

As the MineOne episode demonstrates, FIRRMA's expansion of CFIUS review to include real estate transactions gives the agency a hook to review "greenfield" investments, which involve establishing new business operations from the ground up. If the investor chooses not to clear the initial real estate acquisition through a voluntary filing, CFIUS has the authority to review the transaction at a later date and potentially order divestiture on real estate grounds. CFIUS' indirect authority to review greenfield investments is particularly relevant for foreign investors with plans to build out businesses or facilities in potentially sensitive industries like critical technologies and infrastructure.

CFIUS in the Trump Administration

In February, the Trump Administration outlined its foreign investment and national security policy in a presidential memorandum called the "America First Investment Policy" (the "AFIP"). The AFIP highlights the administration's goals to (1) attract investment from U.S. partners and allies, (2) reduce the regulatory burden for certain low-risk transactions, and (3) increase protections against foreign adversarial influence, particularly from the People's Republic of China ("PRC").

Since the AFIP's release, the Administration has taken steps to implement its stated goals, including developing a "fast-track" review process to facilitate faster risk-based assessments. On May 8, Treasury announced a pilot program for a "Known Investor" portal designed to collect investor information before a filing is submitted. While initially limited to select participants, the program will likely benefit investors who carefully document ownership and organizational structures to demonstrate distance from influence by the PRC or other U.S. adversaries.

A less burdensome regulatory process has clear benefits for real estate investors from U.S. partners and allies, but there are also potential risks for investors with plans to build out new businesses. AFIP directly states that "economic security is national security" and highlights the administration's intention to seek legislation giving CFIUS statutory jurisdiction over greenfield investments. These stated priorities signal the Administration's potential willingness to expand CFIUS review beyond strictly national security issues to a broader "public interest" standard that evaluates the project's net benefits. With this in mind, real estate investors with plans to build out greenfield projects should undertake early political assessments in addition to the traditional CFIUS risk analysis.

Conclusion

FIRRMA expanded CFIUS' jurisdiction to include certain real estate transactions, introducing a new risk analysis for foreign investors in the Gulf South who must now decide whether to alert CFIUS of a covered real estate transaction through submission of a voluntary filing.

While the Trump Administration has taken clear steps to facilitate foreign investment from U.S. partners and allies by reducing regulatory burdens and streamlining the CFIUS review process, foreign investors should carefully assess potential political sensitivities in light of the administration's stated position that "economic security is national security."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.