- within Tax topic(s)

- in United States

- within Law Practice Management, Wealth Management and Coronavirus (COVID-19) topic(s)

Before you is the Autumn edition of 2025. This edition features

many tax changes resulting from governments, especially in

Indonesia, Korea, the Philippines, and Vietnam, raising taxes in

order to make ends meet, while India is looking to replace the old

income tax law by a rewritten new law with more user-friendly

language. Hong Kong is considering various tax reforms in order to

attract more investment in commodity trading and investment funds

(including family offices) and Hong Kong, Korea and Vietnam have

issued legislation and guidance in respect of the Global Minimum

Tax that took effect previously. On a positive note, the PRC has

relaxed its rules for withholding tax exemption if a foreign

company reinvests a Chinese company's profits in China and it

has relaxed its rules for input VAT credits if a Chinese company

exports goods abroad.

We trust you will find something of interest in this bulletin and

as always, please do not hesitate to contact your Mayer Brown

lawyer if you have any questions.

China (PRC)

Dividend reinvestment tax incentive

Courtesy Garrigues in Shanghai, the Ministry of Finance, the State Administration of Taxation (SAT) and the Ministry of Commerce have jointly released an announcement on the tax credit policy for direct investment by overseas investors using distributed profits (the "Tax Credit Policy") on June 27, 2025, in order to boost the economy, further encourage overseas investments, and promote continuing operations within China on a long-term basis. The Tax Credit Policy provides the overseas investors tax credit on distributed profits that are re-invested directly in China by satisfying certain conditions.

There are prevailing tax preferential policies introducing deferred withholding tax on distributed profits reinvested directly by overseas investors in China under:

- Cai Shui (2018) No. 102, Circular on Expanding the Applicable Scope of the Policy of Temporarily Not Levying the Withholding Tax on Distributed Profits Used by Overseas Investors for Direct Investment (Circular 102), issued by The Ministry of Finance, the State Administration of Taxation (SAT), the National Development and Reform Committee and the Ministry of Commerce; and

- SAT (2018) No.53, Announcement of the SAT on Issues Concerning Expanding the Applicable Scope of the Policy of Temporarily Not Levying Withholding Tax on Distributed Profits Used by Overseas Investors for Direct Investments (Announcement 53), issued by the SAT.

Circular 102 and Announcement 53 are collectively referred to as "Tax Deferral Policies".

To illustrate the additional benefits offered by the Tax Credit Policy, we hereby make an example below for reference.

Example

A Chinese resident company, A, distributes dividends of CNY 10 million to its overseas investor B in July 2025.

B uses the dividends of CNY 10 million to reinvest in a Chinese resident company C in August 2025 and withdraws the investment in January 2031.

A distributes dividends of CNY 2 million to B every July from 2026 to 2030.

B, as a non-resident taxpayer in China, the applicable taxation in the given example includes the followings (assuming that treaty benefit is not applicable):

Tax deferral for dividend reinvestment = CNY 1 million (withholding EIT at 10%)

Tax credit obtained in 2025 from dividend reinvestment = CNY 1 million

Withholding EIT at 10% on dividends per year from 2026 to 2030 = CNY 0.2 million

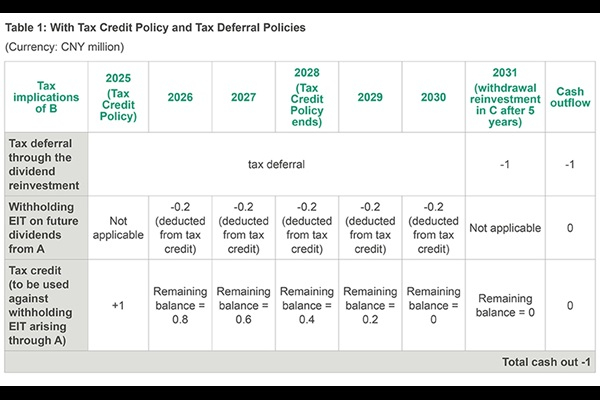

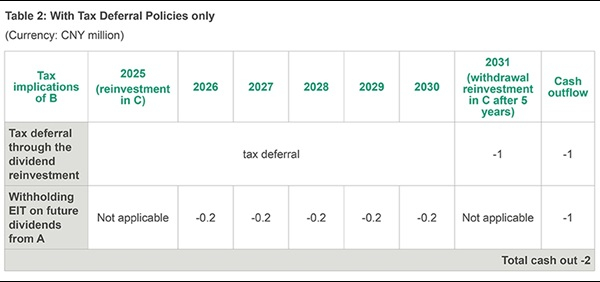

The following tables show the tax impact under different scenarios: (1) Table1: applying both Tax Credit Policy and Tax Deferral Policies; and (2) Table 2: applying Tax Deferral Policies only.

In Table 1, the deferred tax of CNY 1 million is paid when the reinvestment is withdrawn in 2031. However, the withholding EIT on future dividends distributed from A to B (i.e., CNY 0.2 million per year from 2026 to 2030) are not paid to the Chinese tax authority by exploiting the Tax Credit Policy. The total cashflow impact in Table 1 is CNY 1 million cash out.

In Table 2 there is CNY 2 million cash out in total, due to the absence of CNY 1 million tax credit to offset the withholding EIT arising from the dividend distribution for the period from 2026 to 2030.

The Tax Credit Policy offers an additional benefit on top of the Tax Deferral Policies to overseas investors for direct dividend reinvestment in China in terms of tax savings and improving the cash flow efficiency of the overseas investors. Overseas investors that have existing investment in China and intend to carry out a new investment in China from January 1, 2025 to December 31, 2028 may draw special attention to the Tax Deferral Policies and Tax Credit Policy.

Indirect tax policies for Hainan Free Trade Port

The Ministry of Finance, General Customs and State Taxation Administration has jointly issued a notice to stipulate the policies for goods entering and leaving the "first line" and "second line" of the Hainan Free Trade Port (HFTP).

The "First Line"

For the purposes of customs and indirect taxes, the entrance (import) of goods into or leaving the HFTP can be divided into the "first line" and the "second line". The "first line" is established between the HFTP and foreign countries or regions outside the customs territory of China. Goods entering the HFTP through the "first line" will be exempt from import duties, value added tax (VAT) at the import stage, and consumption tax, unless the goods concerned are listed in the catalogue of taxable goods or import of which is prohibited by the national laws and regulations. The exempted goods are called "zero-tariff" goods and will be recorded and administered in digital accounts separately from the normal customs procedure.

The taxpayers eligible for exemption include enterprises with legal personality, public institutions, and the approved private non-enterprise entities in science, technology and education registered in the HFTP. The eligible taxpayer can elect to opt out from the "zero-tariff" policy. Once the election is made, the decision cannot be revoked within 12 months. The list of eligible taxpayers will be determined by the provincial government of Hainan.

Yachts, vehicles and aviation are also exempted from import duty, VAT at the import stage, and consumption tax imported by the enterprises in transportation and tourism sectors for their own use within the HFTP if they are imported for their own use in their businesses within the HFTP.

The "Second Line"

The "second line" is established between the HFTP and other regions with the customs territory of China. The goods and processed products entering the mainland through this "second line" are subject to import duty, VAT at the import stage, and consumption tax in accordance with standard national custom declaration procedures. However, exemptions apply when such taxes have already been paid at the "first line" or during inter-transactions between eligible taxpayers within the HFTP. If VAT has been paid on the transfer of goods within the HFTP, no additional VAT will be levied at the "second line" at the time of the entrance into the mainland of China.

The processed products containing imported components the added value of which exceeds 30% are exempt from import duty when entering the mainland through the "second line" if they are produced by the enterprises engaged in the encouraged industries within the HFTP.

Transfer of Goods and Processed Products Within the HFTP

The transfer of goods and processed products between the taxpayers within the HFTP are exempted from import duties, VAT at the import stage, and consumption tax.

Goods Entering the HFTP From the Mainland or Leaving the HFTP to Go Abroad

Goods entering the HFTP from the mainland through the "second line" will be treated as domestic transactions and taxed accordingly, and goods leaving the HFTP to abroad through the "first line" will be considered as export.

The policies are announced in Announcement of the Ministry of Finance, General Customs and State Taxation Administration [2025] No. 12 and will apply from the date of the operation of the bonded zone, from 18 December 2025. Additionally, China also published a catalogue listing the taxable goods (not exempted goods) in a separate announcement via Announcement of the Ministry of Finance, General Customs and State Taxation Administration [2025] No. 13.

New tax-related information reporting regime for online platforms

In a landmark development for internet platforms, the Chinese government has recently introduced a new regime mandating internet platforms to regularly report tax-related information to Chinese tax authorities. This new regime, formulated by the Provisions on the Reporting of Tax-related Information by Internet Platform Enterprises promulgated by the State Council (State Council Decree No. 810, and the accompanying State Taxation Administration (STA) Announcement on the Matters Relevant with Reporting of Tax-related Information by Internet Platform Enterprises (STA Bulletin [2025] No. 15), will significantly impact online platforms that are engaged in online transactions, covering both China domestic and overseas platforms.

Amendments to the input VAT refund policy

China has released its latest updated VAT refund policy via Announcement of the Ministry of Finance and State Taxation Administration [2025] No. 7. Under the current VAT regime, the input VAT is generally offset against the output VAT with some exceptions. Effective from the VAT filing period for the month of September 2025 onwards, VAT taxpayers that satisfy the conditions may apply for a partial or full refund of the uncredited input VAT remaining at the end of the filing period.

Full Refund for Four Industries

Taxpayers engaged in manufacturing, scientific research and technology service, software and information technology, and ecological protection and environmental management may claim a full refund of uncredited input VAT on a monthly basis.

Partial Refund for Real Estate Developers

Taxpayers engaged in real estate development may claim a 60% refund of the newly increased uncredited input VAT accrued over 6 consecutive months preceding the end of the 6th month, provided the following conditions are met:

- the newly increased amount, in comparison with the amount at the end of 31 March 2019, is greater than zero; and

- the balance of the newly increased uncredited input VAT at the end of the 6th month exceeds CNY 500,000.

The STA has provided the example below to illustrate and explain the rule.

A taxpayer engaged in real estate development applies for the input VAT refund in the tax return of September 2025. The amounts of uncredited input VAT of the 6 preceding consecutive months are as per the table below.

|

Month |

Uncredited input VAT (CNY) |

|

April 2025 |

300,000 |

|

May 2025 |

400,000 |

|

June 2025 |

500,000 |

|

July 2025 |

250,000 |

|

August 2025 |

500,000 |

|

September 2025 |

800,000 |

The balance of the uncredited input VAT of the filing period in March 2019 (the reference period) amounts to CNY 200,000. In this example, all the monthly balance is greater than zero and the balance of the newly increased amount at the 6th month (i.e., September 2025) is CNY 800,000 and exceeds CNY 500,000. The real estate developer qualifies for the partial VAT refund under the policy.

Partial Refund for Other Enterprises

Taxpayers other than those specifically mentioned above may claim the partial 60% refund and may be eligible for a partial refund, subject to conditions. If the monthly balance of the uncredited input VAT over the six preceding consecutive months is greater than zero, and the newly increased balance at the end of the sixth month period exceeds CNY 500,000, the taxpayer may claim a refund. If the increased amount is up to CNY 100,000 million, 60% of the newly increased amount may be refunded, and 30% may be refunded for the portion exceeding CNY 100,000 million.

Hong Kong

Tax plans to promote investments

On 15 September 2025, Hong Kong SAR's Chief Executive delivered the 2025 Policy Address serving as a roadmap for Hong Kong to strive for a vibrant economy, pursue development and improve the livelihood of the population. The government outlined a series of tax reforms aimed at boosting strategic industries, enhancing cross-border investment and strengthening digital economy oversight.

Strategic Enterprise Incentives

The government will offer customized tax packages to attract high-value-added enterprises in sectors such as advanced manufacturing, new energy, life and health technology, and artificial intelligence. A new mechanism will allow the Chief Executive and Financial Secretary to introduce targeted tax incentives that comply with international standards.

Asset and Wealth Management Enhancements

To strengthen Hong Kong's role in global asset management, the government will enhance tax incentives for funds, single family offices and carried interest. Currently, Hong Kong has lost terrain to Singapore in this sector. Expectations are that the new proposals will seek to include more asset classes and types of income (other than just gains on the sale of equity securities) within the scope of tax-exempt income for qualifying private equity funds.

The Capital Investment Entrant Scheme (CIES) will also be enhanced. The CIES grants investors residency rights through investment in specified assets, and applicants of this scheme are currently required to invest at least HKD 30 million in Hong Kong, which includes a maximum amount of investment in real estate (both residential and non-residential) of HKD 10 million. The maximum amount of investment will be increased from HKD 10 million to HKD 15 million for the purchase of non-residential properties with no transaction price threshold. For the purchase of residential properties, the investment to be counted will continue to be capped at HKD 10 million, but the transaction price threshold will be lowered from HKD 50 million to HKD 30 million.

Commodity Trading Tax Concessions

A 50% profits tax concession will be granted to commodity traders establishing businesses in Hong Kong to drive demand for shipping and professional maritime services. Legislative amendments to implement this measure are expected in the first half of 2026.

Digital Economy and Tax Transparency

The government will enhance international tax cooperation to address cross-border tax evasion in digital asset markets. The Securities and Futures Commission will introduce automated reporting and data surveillance tools to mitigate tax risks associated with digital assets in Hong Kong.

Green Finance and Carbon Trading

Hong Kong will deepen its collaboration with the Greater Bay Area on carbon market development, including cross-border trade settlement, voluntary carbon credit standards and methods, as well as the registration, trading and settlement of carbon emissions reduction.

Fertility Tax Incentive

The government proposes to extend the claim period of additional child allowance for newborns from 1 year to 2 years. Starting from the 2026/27 assessment year, a taxpayer may claim HKD 260,000 (i.e., the current allowance HKD 130,000 for two years) for each child in the first 2 years following childbirth.

The above measures will only be implemented after completion of the relevant legislative processes.

Tax treaty with Jordan

On 4 September 2025, Hong Kong signed a double tax treaty with Jordan. Based on the tax treaty, the withholding tax on dividends, interest and royalties will be reduced in Jordan from 10% to 5%. Presently, Hong Kong only levies a withholding tax on royalty payments. The treaty will take effect after it has been ratified by both jurisdictions.

Global Minimum Tax – Pillar 2

On 6 June 2025, Hong Kong enacted legislation to implement the Pillar Two rules with both the Income Inclusion Rule (IIR) and Hong Kong Minimum Top-Up Tax (HKMTT) effective for fiscal years beginning on or after 1 January 2025 and the Undertaxed Profits Rule (UTPR) to be implemented at a later stage. Hong Kong's Pillar 2 rules are consistent with the OECD's Pillar 2 rules.

To view the full article click here

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2025. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.