- within Finance and Banking topic(s)

- with Finance and Tax Executives

- in United States

- within Finance and Banking topic(s)

- within Finance and Banking, Strategy and Criminal Law topic(s)

- in United States

- with readers working within the Advertising & Public Relations, Aerospace & Defence and Banking & Credit industries

Executive Summary

From pivotal elections to advances in artificial intelligence (AI) to heightened geopolitical tensions, the events of the past year have only amplified the challenges of fighting financial crime. Our latest research—based on a survey of over 600 executives across the globe—can help leaders prepare for what's next.

With AI-powered cybercrime disrupting businesses across industries and regulators imposing billion-dollar penalties for compliance failures, more than 70% of executives expect financial crime risk to increase in 2025 (Q2)—compared to 67% in 2023—yet only 23% believe their organization's compliance program is "very effective" in combating it (Q5).

These are among the key takeaways from Kroll's 2025 Fraud and Financial Crime Report, which surveyed 625 business leaders in the U.S., the UK, Europe, Asia Pacific, the Middle East and Africa. Respondents included CEOs, chief compliance officers, general counsel, and chief risk officers from leading financial services, accounting, insurance and legal services firms. (See full report methodology here)

In addition to assessing financial crime expectations, concerns and readiness for the year ahead, the report examines how AI can fight—or enable—illicit activity and captures current sentiment around geopolitical threats, evolving regulations, supply chain risks and more.

A Fast-Changing Financial Crime Landscape

In the coming months, new leadership across major economies could reshape financial crime regulatory and enforcement activity—with potentially significant consequences for how governments handle economic sanctions and anti-money laundering (AML) rules. These shifts come as the continued expansion of such requirements beyond the financial services sector deepens compliance pressures on regulated "gatekeeper" industries, from accountancy to legal services to gaming.

At the same time, swift advances in technology are deepening financial crime risk as organizations race to get ahead of bad actors. Cyberattacks and the increased use of AI by cybercriminals are the top two reasons why respondents expect financial crimes to increase in 2025 (Q3). Respondents cite rapidly evolving technologies as the top hurdle causing governments to lose ground in the fight against financial crime (Q8).

Companies are also ramping up efforts to account for risk around digital currencies (Q26) as cryptocurrency moves from the dark web to Main Street. Nearly 3 in 10 (29%) respondents accept, recognize or transact in crypto, and roughly another third (32%) are considering doing so (Q25)—even as 59% of respondents say the financial crime threat it poses is a moderate or significant concern for their organization (Q27).

On the other hand, technology is an increasingly critical tool for fighting illicit economic activity. Fifty-seven percent of respondents believe AI will benefit their financial crime compliance programs (Q23), and nearly half expect to invest in both AI solutions and non-AI technology as part of their internal steps to tackle the expected increase in such risks (Q18).

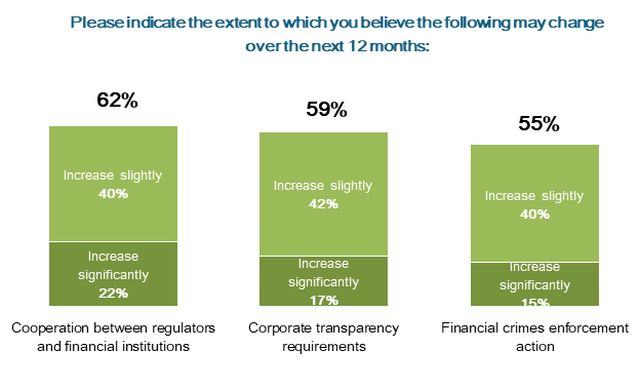

Respondents are concerned about what may be on the regulatory horizon (Q1) as well. Sixty-two percent expect cooperation between regulators and financial institutions to increase in the next 12 months, with similar forecasts for corporate transparency requirements and financial crimes enforcement action (Q6).

Meanwhile, persistent conflicts in Ukraine and the Middle East highlight the complexity of sanctions compliance, while escalating tensions between key economic powers fuel cyberattacks on private businesses and individuals. However, only 39% of respondents are "very confident" in their own financial crime compliance program's sanction screening capabilities (Q10), and just a third say their programs are very prepared to address geopolitical issues over the next 12 months (Q14).

More broadly, our research revealed gaps in technology implementation, governance and sectoral readiness. This could pose significant problems for some industries in 2025, with our data showing real estate and legal services lagging behind accountancy, financial services, and insurance on some key aspects of financial crime preparedness (Q4).

Preparing for What's Ahead

There's room for optimism, too. Seventy-nine percent of respondents expect their organization's compliance function to take on more responsibility (Q1)—and 8 in 10 respondents also say their organization is meaningfully committed to a culture of integrity and senior management supports the compliance function.

And a significant percentage of respondents are taking steps to mitigate financial crime in 2025, whether they are investing in technology, increasing their cybersecurity budget (47%), assessing risk more frequently (41%), or implementing additional controls (39%) (Q18).

In the following report, we'll take a closer look at what our research reveals and provide actionable guidance to help leaders navigate the changes across today's increasingly complex financial crime landscape.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.