- within Government, Public Sector, Real Estate and Construction and Strategy topic(s)

Key Takeaways:

- As creative agencies expand into media placements and talent procurement, revenue recognition decisions under ASC 606 grow more complex.

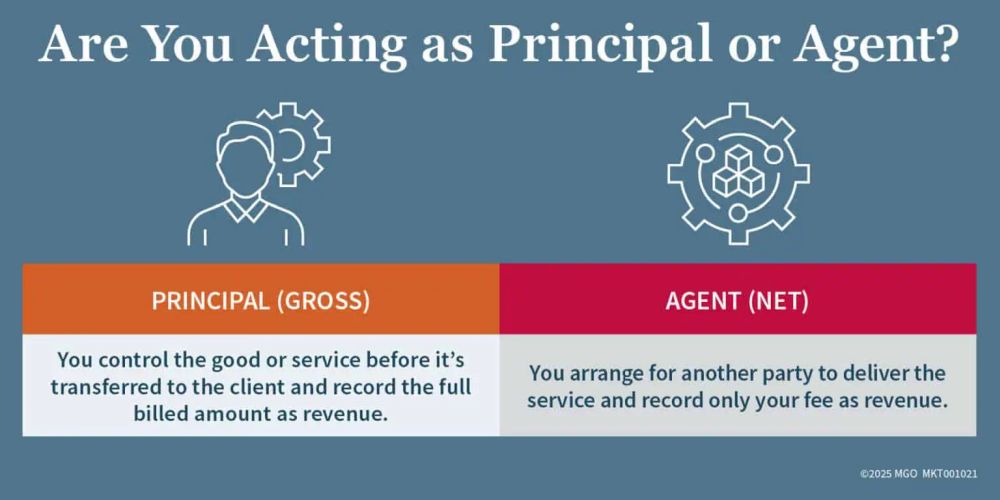

- Determining whether you act as a principal (gross) or agent (net) comes down to control, risk, pricing, and integration.

- Clear policies, contract structures, and documentation are key to avoiding reporting missteps.

—

As your marketing, advertising, or creative agency expands its service offerings — from traditional brand campaigns to influencer activations, digital media placements, and celebrity talent procurement — you also increase the complexity of your financial reporting. One question that continues to surface for agency CFOs, controllers, and leaders: Should we recognize revenue on a gross or net basis for media placement and talent procurement services?

The answer depends on whether you're acting as a "principal" or an "agent" under ASC 606, the accounting standard that provides a unified framework for recognizing revenue from customer contracts. While the framework seems straightforward in theory, in practice it requires careful evaluation of contracts, risks, and how each service is delivered — especially in scenarios where your agency:

- Purchases media placements on behalf of a client (Google Ads, billboards, etc.)

- Hires celebrity talent or influencers for campaigns

- Engages subcontracted production vendors

Principal Versus Agent: The Core Distinction

ASC 606-10-55 directs you to assess your role for every promised good or service to determine if you are a principal or an agent. According to ASC 606, an entity is a principal if it controls the good or service before it is transferred to the customer. Conversely, an entity is an agent if it arranges for another party to provide the good or service.

To make this determination, you'll want to focus on several factors:

- Control: Do you control the media inventory or talent service prior to transfer?

- Inventory risk: Do you take on financial risk, such as committing to ad spend or talent fees before reimbursement?

- Discretion in pricing: Do you set the price for the end customer?

- Integration and customization: Is the media or talent integrated with your broader campaign strategy?

A Practical Framework for Agencies

Instead of wrestling with hypothetical numbers, finance leaders should focus on building a repeatable framework to evaluate each engagement. Consider these four questions:

- Do we obtain control of the media, talent, or vendor services before the client does?

- Do we bear liability if the service underperforms, is canceled, or costs exceed estimates?

- Do we have the ability to set the price billed to the client, rather than passing through vendor costs?

- Is this service a stand-alone item, or is it integrated with the creative campaign we are delivering?

If you answered "yes" to most of the questions, you're likely acting as a principal and should recognize revenue on a gross basis. If you answered "no" to most of the questions, you're likely acting as an agent and should recognize revenue on a net basis.

This approach ensures your team applies ASC 606 consistently across new and evolving services, whether it's a digital media buy, influencer activation, or subcontracted production.

Why Contract Structure Matters

Your revenue recognition conclusion doesn't just live in your accounting memos, it starts with your contracts. Certain clauses will push you clearly toward gross or net treatment:

- Ownership of purchases: Does the agency contract directly with the media vendor or talent?

- Cancellation liability: Who is responsible if placements go unused or talent cancels?

- Pricing authority: Is the agency empowered to set the final client price, or only pass through costs?

- Integration language: Does the agreement show that the service is part of a broader, integrated campaign?

When these issues are addressed upfront, it becomes much easier to defend your treatment during audits or due diligence.

Why Your Choice Matters

The decision between gross and net recognition has consequences beyond compliance. If you report on a gross basis, your top-line revenue increases — a factor that can influence valuation, lending agreements, or how external stakeholders view your growth trajectory. However, this approach can also dilute your reported margins since the inclusion of pass-through costs tends to lower your overall percentage margins.

The implications extend to how your agency is managed day-to-day. Internal controls must evolve to clearly identify principal-versus-agent projects on a case-by-case basis. Meanwhile, client contracts should spell out ownership of purchases, liability for cancellations, and pricing authority. Without these measures, your financial reporting can become inconsistent, which may raise red flags during audits or due diligence.

Best Practices for Agencies

Balancing creative excellence with financial discipline requires structure. Agencies that consistently get this right take deliberate steps to strengthen their processes, contracts, and documentation. Consider these best practices:

- Implement a principal-agent checklist at the kickoff of each engagement to support consistent decision-making.

- Train client service teams on how contract structuring and wording can directly impact financial reporting.

- Maintain clear documentation for each revenue stream, especially when preparing for audits or pursuing outside capital.

- Engage with professionals early by drafting a technical memo and supporting contract extracts that can guide both management and auditors.

By embedding these practices into your operations, you not only stay compliant with ASC 606 but also give your agency the tools to tell its financial story with confidence. That clarity can be the difference between financial reporting that raises questions — and reporting that instills trust with clients, investors, and partners.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.